Foreign investors rattle forex market

•External reserves record first decline of $72m

•I&E weekly turnover drops 3months low

•CBN intervene with $503m

•Exchange rate fluctuates

FOLLOWING the upsurge in demand for dollars last week by foreign investors, Nigeria’s foreign exchange market came under pressure with analysts in divergent views as to the impact on the market this week.

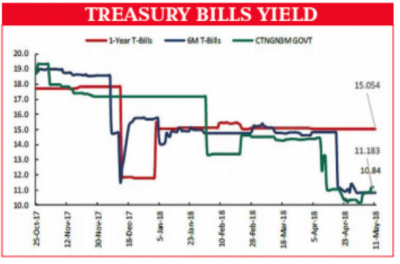

Financial market dealers told Financial Vanguard that the demand pressures were prompted by portfolio rebalancing by foreign investors away from emerging markets, dividend repatriations as well as response to declining yield on government securities in Nigeria.

The increased demand for dollars last week halted the steady increase in the nation’s external reserves. For the first time since July last year, the external reserves recorded a decline, shedding off $72 million or 0.17 percent week-on-week (WoW).

According to the CBN’s latest update, the external reserves dropped to $47.79 billion as at Thursday last week, from $47.87 billion previous Thursday.

Furthermore, the amount of dollars traded (turnover) per week in the Investors and Exporters (I&E) window of the foreign exchange market dropped below $1 billion for the first time in three months. Financial Vanguard analysis showed that the weekly turnover dropped by 16 percent to $976 million last week from $1.17 billion the previous week.

Though the naira appreciated WoW in the I&E by 20 kobo as the indicative exchange rate dropped to N360.85 per dollar on Friday from N361.05 the previous week, the exchange rate fluctuated daily throughout the week as a result of the demand pressure.

It had depreciated on Monday to N361.61 per dollar, its lowest level in the I&E window this year. Though the I&E exchange rate retreated below N361 per dollar on Tuesday and Wednesday, it rose above N361 per dollar again on Thursday to N361.22 per, before falling to N360.85 per dollar on Friday, following intervention of the CBN in the I&E window.

Rebalancing of investment

Financial Vanguard investigation revealed that the increased dollar demand is fuelled by three major factors: foreign investors rebalancing their investment away from emerging markets in response to developments in Argentina, Egypt and Turkey; foreign investors repatriating dividend from Nigerian companies, and foreign investors responding to declining yield on Nigerian government securities.

Ayo Akinwunmi, Head of Research, FSDH Merchant Bank, however, projects that the demand pressure will not likely persist. Speaking to Financial Vanguard, he said: “The yield on federal government securities seems not to be attractive to some foreign investors, so maybe some people are taking some money out.

Weekly Investors and Exporters turnover

And given that we are going to be seeing some increase in yield in some of the advanced countries because of the normalisation, so the external reserves declined a little bit in the last few days in reaction to that.

“It may likely be a temporary issue, as the economy continues to improve, just in line with what we said in our last outlook. We think that the yield on Treasury Bills may go down a bit below current levels as yield on federal government bonds begin to increase, we may likely see the foreign investors coming back again.”

Expressing the same optimism, a senior treasury officer in one of the foreign affiliated banks also said: “It is nothing to worry about. It is not a Nigeria specific situation.

Standalone country

Nigeria itself is doing better now than it was doing when they were bringing in the flows earlier in the year. It is a standalone country. And the investors recognised that and are not taking decisions based on concerns about Nigeria.”

Explaining the factors driving the increased dollar demand, he said: “Yes the foreign exchange inflows have slowed down. It is not unrelated to the pressure that emerging markets are facing generally, the issues in Argentina, developments in Turkey and Egypt. So it is not a Nigeria specific issue. In fact Nigeria is benefiting from Mr. Trump’s policies on Iran and you can see it in the price of crude oil.

International investors generally operate with ‘Herd Effect’ and when things are happening, they just classify everybody has emerging market, and they try to balance or rebalance their portfolio, especially in countries where they see they are making some money. They will say ‘let’s take out some money before it all disappears’.

“They also, for the first time, wanted to test the I&E window because what we have been seeing in the I&E is largely one way flow or direction, which has been inflows. So they also thought it is important to test that window in a period like this. So we have actually seen some investors not only slow down but actually take some money out. That is also responsible for the slight dip in reserves because the CBN has also done what is appropriate, which is to support the I&E market. This also coincided with a period where a lot of corporates are paying dividend. So it is combination of dividend pressure and some slight international flow reversal that led to this development. The falling yield on government securities is just reinforcing these factors.”

CBN raises weekly forex intervention to $503m

In addition to its intervention in the I&E window to restore the indicative exchange rate below the N361 per dollar mark, the CBN raised the volume of its weekly intervention in the interbank foreign exchange market to $503 million.

On Monday the apex bank injected its regular weekly $210 million, allocating $100 million to the wholesale segment, $55 million to the SME window, and $55 million for invisibles. This was followed with additional $293 million on Friday.

Confirming the additional intervention, Acting Director, Corporate Communications Department, CBN, Mr. Isaac Okorafor, said that the sum, as in previous interventions, were in favour of interests in the agricultural, aviation, petroleum products, raw materials and machinery sectors.

Raw materials and machinery sectors

Okorafor reiterated that the objective of the CBN intervention in the foreign exchange market remained to ensure liquidity in the foreign exchange market and enhance production activities.

He stated that the CBN would continue to ensure liquidity in the interbank sector of the market as well as sustain its interventions in order to drive economic growth and guarantee market stability.

While analysts at Lagos based Afrinvest opined that the naira will remain stable in spite of the increased demand for dollars, citing the intervention of the CBN, analysts at another Lagos based investment house, Cowry Asset Management Limited, however projected that the increased demand for dollars will lead to further naira depreciation in I&E in this week.

“Whilst we believe increased demand for the dollar could weigh on foreign reserves, we expect the impact of CBN weekly intervention in the foreign exchange market to keep rates at similar levels across market segments,” said Afrinvest analysts.

Cowry Asset analysts however projected: “This week, we expect depreciation in the exchange rate at the

I&E as 0.17 percent WoW decrease in the external reserves to $47.79 billion in the concluded week showed pressure on the green back.” (Vanguard)