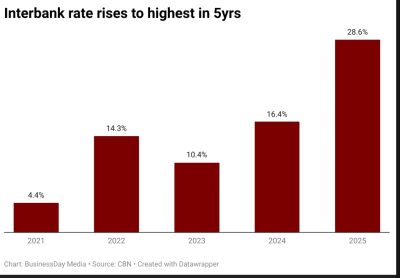

Interbank rate hits 5 yr-high as CBN tightens liquidity

Nigeria’s interbank lending rate surged to a five-year high of 28.58 percent in January 2025, reflecting the Central Bank of Nigeria’s (CBN) aggressive monetary tightening measures.

The interbank rate is the interest banks charge one another for short-term loans, typically overnight, to cover daily liquidity needs.

A rising rate signals tighter cash conditions, making it costlier for banks to access funds, which in turn raises borrowing costs for businesses and consumers.

Data from the CBN shows a dramatic rise in interbank rates over the past five years, with rates going from as low as 4.40 percent in January 2021 to a peak of 28.58 percent in January 2025.

Analysts say this spike reflects the CBN’s shift from an expansionary stance in 2020, which kept borrowing costs low, to a much tighter policy aimed at controlling inflation.

Businesses face higher borrowing costs

The MPR—CBN’s benchmark interest rate—has climbed from 11.50 percent in 2021 to 27.50 percent currently, with a hefty chunk of that rise coming in the last one year during which the CBN hiked rates by an unprecedented 875 basis points.

The CBN has raised rates to combat rising inflation.

“The spike in interbank rates aligns with the CBN’s tighter monetary stance,” said Ayokunle Olubunmi, head of financial institution ratings at Agusto & Co. “This has raised funding costs for businesses, with prime lending rates now exceeding 30 percent.”

Funmi Adebowale, head of research at Parthian Partners, said, “This sharp increase reflects underlying changes within the financial system and has important implications for the broader economy.”

She said one of the primary drivers of higher interbank rates is CBN’s tightening of monetary policy, which is aimed at curbing inflation and stabilising the exchange rate.

The Monetary Policy Rate (MPR) serves as the anchor for all interest rates in the economy. When the CBN raises the MPR, borrowing becomes more expensive, prompting commercial banks to pass on these costs in the interbank market. This results in higher call rates—the short-term rates banks charge one another for overnight loans.

Another key driver of rising interbank rates is liquidity shortages. There is an inverse relationship between liquidity levels and interest rates—when liquidity is tight, banks borrow from one another to meet daily obligations. As demand for funds increases, the cost of borrowing (interest rates) rises, pushing short-term rates higher.

On the economic implications, Adebowale said high interbank call rates have significant implications for the economy.

One is the higher cost of credit. With banks facing increased funding costs, the cost of credit for businesses, particularly SMEs, will rise.

This could dampen investment and consumption, key drivers of economic growth. Higher borrowing costs also exacerbate inflation, particularly if businesses pass on the increased costs of financing to consumers. Furthermore, tighter access to credit can lead to reduced economic activity, intensifying supply-side inflationary pressures.

Tilewa Adebajo, CEO of CFG Advisory, also said the rising interbank rates reflect the CBN’s decision to hike the MPR in an effort to curb inflation.

While the tighter monetary policy has helped lower inflation—which dropped to 23.18 percent in February 2025 from 24.48 percent in January, albeit following a rebasing exercise—it has also drained liquidity from the banking sector.

To curb excess cash, the CBN ramped up its Open Market Operations (OMO), selling N11.8 trillion in securities in 2024, a staggering 1,773.7 percent increase from N627.2 billion in 2023. OMO sales reduce the money supply by absorbing excess liquidity, making borrowing more expensive.

As of March 26, 2025, short-term borrowing rates have soared even further with Overnight lending rate hitting 32.83 percent and the Open repo rate at 32.42 percent.

Higher overnight lending rates indicate that banks are struggling to meet liquidity demands, forcing them to pay steeper interest rates for short-term funds.

Aloysius Uche Ordu, a member of the Monetary Policy Committee (MPC) noted in his personal statement at the MPC meeting in February that while borrowing costs may begin to ease slightly, past rate hikes will continue to impact lending markets.

Businesses and consumers will likely face high borrowing costs in the near term as the CBN maintains its focus on stabilising the economy. (BusinessDay)