Liquidity squeeze hits demand for juicy Nigerian Treasury bills

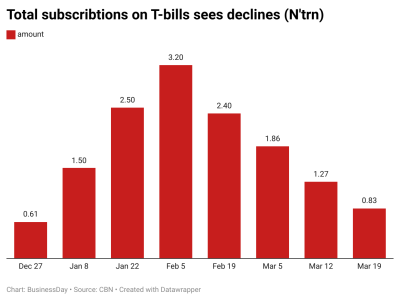

The appetite for Nigeria’s one-year Treasury bills has been on a steady decline, despite the Central Bank of Nigeria’s (CBN) efforts to raise yields in the past two auctions.

In an unexpected move, the CBN revised its auction calendar to include an additional sale on Wednesday. At this surprise auction, yields on one-year Treasury bills climbed to 24.90% from 22.52%—marking the second consecutive increase—as liquidity constraints continued to weigh on the market.

This rise has resulted in a positive real return of 1.72%—the first since May 2020.

However, demand for the one-year bill dropped significantly to N861 billion on Wednesday, its lowest level this year, compared to N1.5 trillion at the first auction of 2025. This comes despite the offer being the largest since February 2024, at N800 billion.

At its peak, demand for Nigeria’s Treasury bills saw N3.2 trillion worth of bids against a supply of just N670 billion.

Liquidity crunch

Tajudeen Ibrahim, head of research at Chapel Hill Denham, attributed the drop in demand to limited system liquidity.

“Domestic demand is largely dictated by system liquidity. On the international front, foreign portfolio investors (FPIs) primarily engage in OMO bills, making it a better gauge of their appetite,” he explained.

“The one-year bill yielding over 24% now offers positive real returns and a lucrative carry trade for FPIs, especially as most international banks maintain their benchmark interest rates,” Tajudeen added.

He also noted that the CBN introduced Wednesday’s auction to cover an N800 billion shortfall in its initial first-quarter Treasury bill calendar.

Matilda Adefalujo, a fixed-income trader, echoed similar sentiments, citing low liquidity as the main factor behind dwindling demand.

“The additional auction was introduced to address multiple concerns, including signaling that NT-bills remain attractive with strong yields and frontloading borrowing ahead of a potential rate cut in May,” she said.

Foreign investors and the naira’s volatility

Earlier in the year, foreign banks expressed bullish sentiments on Nigeria’s Treasury bills. J.P. Morgan, in its report Emerging Market Frontier Local Markets Compass, stated: “We remain long on Nigeria’s T-bills as reform momentum begins to yield results. However, this trade is more about taking a position on the naira.”

The naira started 2024 as one of the best-performing frontier market currencies, holding steady around N1,500 in the first two months. However, since early March, it has come under pressure in the foreign exchange (FX) market, slipping from N1,502 to N1,580 as of Wednesday. This period of depreciation has coincided with the decline in Treasury bill demand.

Global tariff tensions have also fueled investor caution, with many shifting focus to safer domestic assets.

Some analysts also said that FPIs have been exiting the Treasury bill market.

“You may recall that exchange rates began to spike a few weeks ago. This was largely due to FPIs withdrawing funds en masse. To counter this, the CBN raised OMO bill yields to discourage capital flight,” an analyst at Capitalfield explained.

Kingskin Okojie, a treasury analyst at Access Bank, noted in a CNBC interview that FPI participation in Treasury bills has declined, leading to rising yields as the CBN attempts to lure them back.

“There’s a clear correlation between Treasury bill rate declines and FX market volatility. As yields fall, FPIs sell off their holdings to obtain naira for repatriation,” Okojie said.

“However, if yields rise, we may slow the pace of FPI exits. FPIs seek attractive returns on their carry trades, so a yield increase could provide enough incentive to keep their funds in Nigeria,” he added.

Despite the surprise auction, the CBN only sold N436.72 billion worth of one-year Treasury bills and a total of N504 billion across all tenors on Wednesday. This brings total Treasury bill sales for 2025 to N4.7 trillion.

The 182-day and 91-day Treasury bills saw limited interest. Of the N100 billion offered in 91-day bills, only N27.19 billion was sold, while the 182-day bill saw N40 billion in sales. Yields on the 182-day and 91-day bills rose to 20.39% and 18.86%, respectively.

(BusinessDay)