Ten years ago, Louis Carter Industries boomed. Its products were everywhere and sought-after by traders of household items.

The firm’s Nnewi, Anambra State factory, was a beehive of production activities as buyers waited in droves to off-take its plastic gallons and bowls.

But then an economic tsunami struck. Foreign exchange scarcity, which had begun in late 2015, sent raw materials costs through the roof. Cost of production piled. Then, in 2017, the company shut down.

“We had a very rough time with the cost of power. We were challenged by skyrocketing energy costs,” Ndubuisi Okoli, general manager of Louis Carter Industries, told this reporter.

“The Enugu Electricity Distribution Company (EEDC) was not supplying us with power, so our cost of production was getting really high. Also, we had issues with getting raw materials for production,” Okoli said.

Louis Carter is not the only victim of skyrocketing energy costs. One Abuja-based small company named Chemist Industries, which produced nylons, went out of business in 2018 as its production cost ballooned.

“We were running on generators for over 10 hours every day,” Charles Gboh, managing director, said.

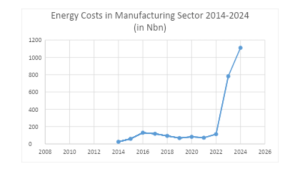

In 10 years, manufacturers’ alternative energy costs rose 44 times, according to BusinessDay’s analysis of data from the Manufacturers Association of Nigeria (MAN).

In 2014, manufacturers spent N25 billion on alternative energy such as generators, diesel, gas, petrol, low-pour fuel oil, among others. By 2024, the cost had risen to N1.1 trillion, representing 44-time increase over the period.

The reasons are not far-fetched. In 2014, petrol price stood at N87 per litre. In 2024, the price had neared N1,000 due to deregulation that happened the year before. The price of diesel was around N111.6 per litre in 2014 but it reached N1,406 by August 2024, said the National Bureau of Statistics (NBS).

In the last 10 years, prices of gas, LPFO, and generators have jumped more than five times as the nation faced one of its worst inflation periods.

Headline inflation was single-digit in 2014, between seven and nine percent, but stood at 28 percent-34 percent in 2024.

“Diesel is now eating up a bigger share of production costs than even raw materials or labour,” Segun Ajayi-Kadir, director-general of MAN, said. “That’s not sustainable.”

Manufacturers’ self-generation

An earlier survey undertaken by Adeola Adenikinju, professor of economics at the University of Ibadan, funded by the European Union and the German government, showed that manufacturers self-generate 13,223 megawatts (MW) of electricity.

The Chemicals and pharmaceuticals sub-sector is the biggest self-generator of power (3,153MW), followed by food, beverages and tobacco sub-sector (2,098MW) and the industrial plastic and rubber sub-sector (2,051MW). It did not factor in the petro refining sector, which had not started then.

“I was a manufacturer in Enugu, and I was burning petrol and diesel for all my productive time. Energy cost is the biggest cost borne by manufacturers,” said Ike Ibeabuchi, who is now an emerging markets analyst.

2024 reality

BusinessDay’s recent survey showed that Nigeria’s 17 corporations saw a 77 percent increase in energy cost in 2024.

The firms with the highest increase included: Okomu Oil (931 percent); Zenith Bank (145 percent); BUA Cement (129 percent); Lafarge Africa (109 percent), and Transcrop (94 percent).

Experts warn that the true scale of the problem is likely far worse, as several large firms either did not report their energy expenditures in detail or lumped them together with other operational costs.

Factory shutdowns

Over the 10-year period, several manufacturing firms have shut down over issues relating to high energy costs, foreign exchange (FX) crunch, policy flip-flops, and poor local content application, among others.

Mothers Pride Ventures, which produced thousands of pet bottles, nylon and plastic cans in Asaba, Delta State, shut down in 2018 due to high energy costs.

Jimoh Dayo, its managing director, told the reporter that DisCos’ lack of power supply contributed immensely to the firm’s closure.

“These DisCos do whatever they like. The 2013 power sector privatisation was wrongly done.”

On the other hand, Moak Industries, which produced bottled water, blamed FX crunch for its closure in 2018.

Other factories which shut down over the period included: Geroegous Metal, Black Star Industries, Federated Steel, Sky Aluminium, Universal Steel, Grief, Errand Products, Evans Medical, Iso Glass, Universal Rubber, among others.

MAN noted that 767 manufacturers shut down operations while 335 became distressed in 2023.

Manufacturers have severally filed lawsuits against DisCos and the Nigerian Electricity Regulatory Commission (NERC) over what they described as arbitrary increases in the electricity bills.

The recently introduced Band A is revving up their costs and they say it could shut more factories.

“Moving forward, stabilising macroeconomic conditions, improving energy supply, and ensuring access to affordable financing will be critical for sustaining growth and enhancing industrial productivity,” MAN said.(BusinessDay)