President Bola Tinubu’s macroeconomic reforms and return to monetary orthodoxy shook the productive sector burdened by high energy costs and interest rates, ARINZE NWAFOR writes. However, industries have remained resilient as the reforms yield results

Stakeholders agree that industries need extra support from the Federal Government to bear the burdens of high interest rates and energy costs. They evaluated President Bola Tinubu’s midterm performance in industrial growth, noting that the administration should complement its economic reforms with resolve to address structural issues.

Director of the Centre for Promotion of Private Enterprise, Dr Muda Yusuf, observed that industries, with the manufacturing sector being the most impacted, have suffered severe vulnerabilities due to the reforms introduced by this administration. “The sector, by nature, has a very high exposure to foreign exchange and energy,” he stated. “The impact of the reforms on energy and foreign exchange was a major shock to the manufacturing sector because it is highly energy-intensive, both for production and for logistics, and highly dependent on raw materials, equipment, and spare parts imports.”

Yusuf explained that the reforms, which he admitted were inevitable, caused manufacturing to suffer “a major setback”, which led to some of the companies declaring huge losses from 2023 to 2024.”

However, Tinubu’s reforms have, according to the World Bank, reduced Nigeria’s fiscal deficit from 6.2 pre cent of Gross Domestic Product in the first half of 2023 to 4.4 per cent in the first half of 2025, as the country’s service sectors grew, foreign exchange improved and the oil sector stabilised. The recently released Africa Development Bank African Economic Outlook 2025 also hailed the economic reforms for Nigeria’s GDP growth across three quarters.

Tinubu’s investment drive

Tinubu’s administration promoted its industrialisation goals from the outset, beginning with the then-presidential candidate’s 2022 campaign promise to “manufacture, create, and invent more of the goods and services the country requires.” His manifesto stated, “Nigeria shall be known as a nation of creators, not just of consumers; export more and import less, strengthening both the naira and our way of life.”

In his 2024 budget presentation address, Tinubu maintained that his administration would create a conducive investment environment, remarking, “A stable macroeconomic environment is important to catalyse private investment and accelerate economic growth. We have and shall continue to implement business and investment-friendly measures for sustainable growth.” The president’s declarations premise the Ministry of Industry, Trade and Investment’s activities.

Tinubu’s administration has pursued foreign direct investment, with the president taking 30 foreign investment trips, according to the Minister of Industry, Trade, and Investment, Dr Jumoke Oduwole. Oduwole revealed that Tinubu’s 30 foreign trips (as of May) have attracted proposed investments worth $50.8bn into the country. But these are only announced investments, which the minister has pledged to “track and make sure that they come to fruition.”

Notably, the Central Bank of Nigeria’s January 2025 Economic Report disclosed that in December 2024, foreign direct investment declined to $0.07bn from $0.12bn, notwithstanding that capital inflow rose to $2.06bn from $1.57bn, buoyed by portfolio investments.

The CBN has given an account of the improved business environment in Nigeria. In its January 2025 economic report, the apex bank reviewed that “On the domestic front, business activity continued to grow, albeit at a slower pace, driven by an increase in new orders and output, particularly in the industry and agriculture sectors.”

A look through the CBN’s January 2025 analysis of capital importation by sector showed that the productive sector of the economy remains in a slump, snatching only 3.01 per cent of the $2.06 bn. Capital importation by sector showed “the banking sector as the highest recipient of foreign capital, accounting for 45.22 per cent of total inflow. This was followed by the financing sector (44.32 per cent), telecommunication (3.86 per cent), the production and manufacturing sector (3.01 per cent), shares (1.57 per cent), and trading (1.43 per cent), while other sectors accounted for the balance.”

Stakeholders, including the Manufacturing Association of Nigeria, have asserted that industry performance under the administration’s two years was hard hit, but they have remained resilient. They have urged the administration to address the challenges bedevilling the sector, from high interest rates to energy tariffs.

Manufacturing sector review

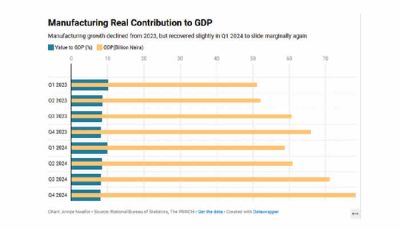

According to the National Bureau of Statistics, in 2024, overall real growth in the manufacturing sector was 1.38 per cent, lower than the 1.40 per cent recorded in 2023, indicating a 1.44 percentage point difference. In 2024, the sector contributed 8.64 per cent to Nigeria’s GDP, lower than the 8.81 per cent it contributed in 2023.

MAN affirmed the 1.44 per cent decline in the real growth of the manufacturing sector through the fourth quarter edition of the 2024 Manufacturers’ CEO Confidence Index. According to the Director-General of MAN, Segun Ajayi-Kadir, manufacturers are fleeing to neighbouring countries as the country’s business environment has grown less conducive.

“We admonish that many of our members are actively considering divesting or relocating their businesses to more conducive neighbouring countries,” Ajayi-Kadir lamented. “All these are the result of the consistent and persistent cost escalation trajectory that we have witnessed in more recent times.”

CPPE’s director, Yusuf, agreed with MAN’s position on the risks industry relocation poses to the Nigerian economy. “Some of the manufacturing firms had to leave, particularly those that are multinational,” he noted. “Many manufacturers had a high forex exposure in credit, raw materials and procurement. When forex shocks kicked in, it affected them badly because they have huge foreign exchange liabilities.”

In October 2024, the exit of South African grocery retailer Pick n Pay, through the sale of its 51 per cent stake in a joint venture, added to the list of multinationals that either closed their Nigerian operations or divested.

Multinationals that exited the Nigerian market in 2023 included Unilever Nigeria Plc, Procter & Gamble Nigeria, GlaxoSmithKline Consumer Nigeria Ltd, ShopRite Nigeria, Sanofi-Aventis Nigeria Ltd, Equinox Nigeria, Bolt Food and Jumia Food Nigeria. Other multinationals, including Microsoft Nigeria, Total Energies Nigeria (impacted by divestment strategies), PZ Cussons Nigeria Plc, Kimberly-Clark Nigeria, and Diageo Plc, relocated out of Nigeria in 2024. These companies blamed Nigeria’s unsustainable operational costs for their inability to thrive in the local market.

Despite the multinationals’ exits, Yusuf expressed optimism that the manufacturing sector is recovering as reforms begin to bear fruit. He explained, “Many multinationals have moved from a loss to a profit position, indicating that they have started to recover from the shocks of those reforms. The good thing is that we are now in a regime of fairly stable exchange rates, and many manufacturers are in recovery mode.”

Manufacturers have bemoaned the interest rates, which remain in double digits. Ajayi-Kadir warned that the CBN’s decision to retain the Monetary Policy Rate at 27.5 per cent since November 2024 was “suffocating the capacity of the manufacturing sector” and undermining national industrial goals.

Other members of the organised private sector, including the Lagos Chamber of Commerce and Industry and the Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture, have also made repeated calls for reduced interest rates, to no visible change yet. The effect of the 27.5 per cent MPR, which sets the benchmark for lending rates, is subdued credit to the industries, thus limiting business expansion.

According to the earlier cited CBN report, “Credit to the industry and services sectors moderated by 0.92 per cent and 1.65 per cent, indicating an adjustment in credit distribution.” For manufacturing (under industry), credit allocation contracted to N8.30bn in January 2025 from N8.53bn in December 2024.

The cost of energy to run factories is a major blow to manufacturing growth. Manufacturers have decried their hefty energy bills, which increased by over 230 per cent, stating that they are “hindering the performance of the sector and the growth of the economy”. Ajayi-Kadir, in a statement in February, warned that “the proposed increase in electricity tariff is inimical to the competitiveness of Nigerian products and businesses.”

In his evaluation, the CPPE boss Yusuf stressed that energy remains “a big issue” worsened by political and social elements. He noted that energy insufficiency has made industries unattractive for investments and criticised the slow pace of energy sector reforms for resulting in dependence on alternative fuels and high inflation, which affected purchasing power, sales, turnover and profits.

Manufacturers added that they spent N1.11tn on alternative energy sources in 2024, indicating a 42.3 per cent rise from the N781.68bn recorded in 2023. Power supply challenges impact other industry sectors beyond manufacturing, particularly the service sector.

A lingering challenge to manufacturers is the forex forward-related dispute, which persisted before and well into the Tinubu administration. MAN has repeatedly called on the CBN to resolve the concerns surrounding a $2.4bn backlog of matured forex forward contracts.

Earlier in May, the association lamented that its members faced stringent requirements that were not in keeping with the CBN’s guidelines, resulting in unnecessary bottlenecks and illegal freezing of their corporate and personal bank accounts.

Manufacturing stakeholders have protested the recent Transmission Company of Nigeria award of electricity meter contracts worth over $100m (approximately N160bn) to two Chinese companies.

The Association of Meter Manufacturers of Nigeria reportedly accused the Federal Government of ignoring local manufacturers capable of executing the multimillion-dollar contract.

Manufacturers in the automotive sector have lamented the weakness of steel manufacturing, forcing them to depend on imports. No Nigerian steel plant is active. Meanwhile, the Tinubu administration, through the Ministry of Steel Development, has promised to revive dormant plants.

The Ministry of Steel Development disclosed that it visited Premium Steel and Mines Ltd in Ovwian-Aladja, Delta State, where it pledged to resuscitate the plant, optimistic that it will generate over 5,000 direct and 10,000 indirect jobs.

Industrial sector successes recorded in the midterm of the Tinubu administration range from targeted policies such as the pharmaceutical inputs and raw materials duty waiver to the broad-based ‘Nigeria First’ procurement policy.

After a nine-month delay, Tinubu’s two-year waiver of import duty and value-added tax on pharmaceutical manufacturing inputs and excipients took off in March. Stakeholders, including the LCCI Medical Group led by Dr Niyi Osamiluyi, lauded the policy as a step in the right direction. Yet, they cautioned that pharmaceutical manufacturers still faced “persistent issues such as unreliable electricity supply, poor transportation networks, and inefficient port operations, which can increase production costs and delay the distribution of medical products.”

Tinubu recently approved the ‘Nigeria First’ policy, mandating all federal ministries, departments and agencies to “prioritise Nigerian goods, services and know-how when spending public funds.” Industry stakeholders commended the procurement policy.

MAN projected that implementing the ‘Nigeria First’ policy would “scale investments and potentially boost GDP by 56 per cent, reduce unemployment by 37 per cent and increase firms’ willingness to employ from 1.5 per cent to 22.6 per cent.” However, they warned that the 27.5 per cent MPR risked thwarting the policy’s potential to drive up local production.

Tinubu’s administration, through the Federal Ministry of Industry, Trade and Investment and its agencies, has maintained open communication channels with industry stakeholders. It has engaged stakeholders in business membership organisation meetings, conferences and trade fairs. An example of such visits is the Minister of Industry, Trade and Investment, Oduwole’s engagement with NACCIMA in December 2024 shortly after her appointment. The PUNCH reported that Oduwole’s visit elicited the association’s goodwill.

Export/Import review

Foreign trade has grown under Tinubu’s administration. NBS data revealed that in 2024, Nigeria recorded a trade surplus of N20.8tn with an export value of N79.11tn and an import value of N58.31tn.

While oil products still account for a large chunk of Nigeria’s exports, the country has recorded an increase in non-oil exports, namely manufacturing goods, agricultural and solid minerals exports. According to the NBS, manufacturing goods exports grew in 2024 by 65.84 per cent from 2023. The gross value of manufactured goods exported in 2024 was N2.28 tn, an increase from the N778.44 bn in manufactured goods export value in 2023.

In April, the Nigerian Export Promotion Council reported that the value of non-oil exports grew by 24.7 per cent to $1.79 bn in Q1 2025 from $1.44 bn recorded in Q1 2024. However, manufacturing exporters insist that unaddressed setbacks, including a hostile operating environment and non-competitiveness of the country’s goods in the foreign markets, hinder a much more brilliant performance than the 65.84 per cent increase.

Members of the OPS have decried poor port infrastructure and increasing taxation as chief contributors to plummeting trade in productive industries. They have lamented the Nigerian Customs Service’s decision to charge a four per cent Free-on-Board levy at ports.

The NCS had withdrawn the four per cent FOB hike following the OPS backlash but announced plans to introduce the charge after claiming to have engaged stakeholders. Meanwhile, manufacturers denied engaging with the NCS and warned that the charge would “inflict catastrophic consequences” on the fragile manufacturing sector.

The association also complained that the charge worsened imports, as the cost of importation had already jumped by over 118 per cent, from N2.07 tn in the first nine months of 2023 to N4.53 tn in the same period of 2024.

Manufacturing exporters have also decried the taxation of monies exporters received under the Export Expansion Grants, warning that it defeated the purpose of the credit-shoring scheme.

For the export consultant and Manufacturers Association of Nigeria Export Promotion Group member, Okhai Ehimigbai, the EEG was a beneficial policy for exporters. However, the scheme’s effectiveness had waned over the years, and Ehimigbai blamed the Federal Government for the decline.

He criticised the government for “leaving the EEG untouched for several years” and accused manufacturing exporters of defrauding the scheme. “By the time they look into the data, they will come and tell you that there is fraud,” Ehimigbai lamented. Until now, the government has been unable to prosecute a single company. But they keep accusing exporters of fraud in EEG.”

Nevertheless, the Tinubu administration has had successes in the export and import business, including tax reviews of free trade zones to support local industries and the facilitation of digital trade protocols under the African Continental Free Trade Area.

The administration has recorded some firsts in foreign trade. In January, Nigeria transported its first shipment of goods under the ACFTA to Mombasa Port, Kenya. On May 26, Oduwole announced the Federal Government’s partnership with Uganda Airlines to cut logistics costs by up to 75 per cent for Nigerian traders exporting to Uganda, Kenya and South Africa.

MSMEs review

The Tinubu administration’s attention to micro, Small and Medium-Sized Enterprises encompasses credit facilitation and related schemes. However, small businesses suffer from low access to credit.

Stakeholders, including the Association of Small Business Owners of Nigeria and the Nigerian Association of Small and Medium Enterprises, faced inflationary shocks as their customer base shrank.

The Tinubu administration’s efforts to hedge against a freefall of business and consumer credit have included a ₦50,000 Presidential Conditional Grant Scheme for nano businesses (employing two or three workers and with an annual turnover of less than ₦3m Presidential Intervention Fund introduced in 2024 for MSMEs and manufacturers, and the establishment of the Nigerian Consumer Credit Corporation. However, stakeholders dispute the success of these government schemes.

In May, the Small and Medium Enterprises Development Agency reported creating 90,160 jobs for unemployed youths in Q1 2025. It also stated that it supported more than 116,000 entrepreneurs nationwide with vital resources, including training, access to finance and markets, and the distribution of work tools.

Extractive sector review

Multiple investment deals have come from the extractive sector under the Tinubu administration. The Minister of Solid Minerals Development, Dele Alake, recently reported that the ministry had secured over $800m in processing projects in 2024. The major projects are lithium processing plants on the Kaduna-Niger State border and in Nasarawa State.

The Solid Minerals Ministry credited the investments to its local value-addition policy and tightened licensing regime. According to the administration, in 2024, revenue in the extractive sector increased by 145.45 per cent from N6bn to N38bn due to sectoral reforms.

Along with its push for solid minerals beneficiation, the administration has also facilitated a deal with the Chinese government to set up electric vehicle factories in Nigeria. However, the extractive sector remains a hotbed for illegal mining and conflicts, despite government efforts.

Getting back on track

To ensure it meets the mark in the next two years, stakeholders have urged the Tinubu administration to resolve structural issues weakening industrialisation and engage more with players in the field.

“The government needs to pay a lot more attention to the structural issues around power and logistics,” CPPE’s director, Yusuf, remarked. “It also needs to look at the tariff on some critical manufacturing inputs; where the tariffs are high, it can give some concession to reduce the import duty on some of their key raw materials, as many manufacturers are still heavily dependent on imports.”

Yusuf also advised the administration to increase capital support for development finance institutions to improve concessionary financing for manufacturers and other investors in the real sector.

He explained, “Since the new monetary policy regime has completely exited from intervention funds, creating some issues for those manufacturers who were beneficiaries, the government needs to scale up the capitalisation of the Bank of Industry, Bank of Agriculture and Nexim Bank to support the manufacturing sector and the real sector of the economy.”

MANEG member Ehimigbai recommended that the government include more business owners in policy management, reduce interest rates and commit to patronising Made-in-Nigeria products over rhetoric.

While he identified locally manufactured vehicles and laptop computers as readily available goods which the government could patronise over foreign models, the export consultant warned that “It is only when the government tells the world, ‘This is what I have; nobody would know.’” (Punch)