Nigeria’s Eurobonds saw increased demand in the first half of 2025, recording the most significant drop in yields among African nations as a result of improving market confidence.

There’s an inverse relationship between bond yields and prices such that lower yields are a signal of increased demand.

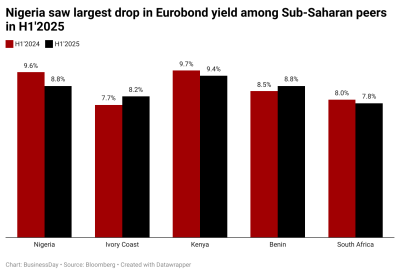

The average yield across Nigerian sovereign bonds decreased by 0.8 percentage points to 8.8 percent by the end of the first half of 2025, from 9.6 percent in the same period the previous year.

Analysts at CSL Stockbrokers said that the compression in yields reflects improved investor sentiment driven by the ongoing reform agenda, upgrade of the sovereign credit rating, and strengthening macroeconomic fundamentals.

In the first half of the year, the naira found renewed stability, supported by a positive current account and a gradual recovery in FPI inflows.

The local currency, which opened the year at around N1,535/$ in the official market, posted a marginal appreciation to close the first half at around N1,530/$, reflecting a YTD gain of 0.4 percent.

Also, inflation started to cool, as of May, Nigeria’s headline dropped to 22.97 percent from 24.48 percent.

All of these and more led to Moody’s Ratings upgrading Nigeria’s long-term foreign currency and local currency issuer ratings to B3 from Caa1 and changing the outlook to stable from positive

“ Looking ahead, we see scope for further yield declines across the curve over the medium term, supported by the potential re-entry into the JP Morgan Emerging Market Bond Index and the relatively attractive valuations compared to peer sovereign credits,” it said.

Of the sovereign bonds, short-dated papers maturing in November 2025, November 2026, and March 2029 recorded the most significant yield compression, averaging a substantial 216 basis points (bps). For instance, the November 2025 paper’s yield fell from 7.49 percent in December 2024 to 5.48 percent by the end of June 2025. This sharp decline stands in stark contrast to the more modest average drops of 95 bps and 47 bps observed in the mid and long-term maturities, respectively.

This is contrary to sentiments across Sub-Saharan African Eurobonds in H1’2025, with a 60 basis point increase in average yield to 8.6 percent from 8.0 percent at the end of 2024.

South Africa recorded a modest drop, with its yields moving from 8.0 percent to 7.8 percent. Similarly, Kenya experienced a subtle decline, with its yields decreasing from 9.7 percent to 9.4 percent, suggesting a marginal easing of borrowing costs in the international market.

Conversely, some nations observed an upward trend in their Eurobond yields during the period. Ivory Coast saw its yields climb from 7.7 percent in H1 2024 to 8.2 percent in H1 2025, reflecting a modest increase in perceived risk or market recalibration. Benin also experienced a slight rise, with yields moving from 8.5 percent to 8.8 percent, underscoring varied market dynamics across the sub-region despite the broader trends.

Similarly, Corporate Eurobond was bearish as average yield advanced 20 basis points to 7.4 percent.

“Despite the average bearish performance, the prospect of more dovish monetary policy calls in As could sway investors’ interest in H2, especially in Ghana’s Corporate Eurobond supported by strong commodities market and strengthening of the Cedis,” analysts at Afrininvest said in its outlook report for H2.

In the second half of 2025, the Federal Government aims to raise $1.2 billion through the DMO and an additional $2.0 billion at concessionary rates through multilateral sources.

“Elsewhere, despite our base case expectation for a 50 to 100 basis points reduction in policy rate, Nigeria’s carry trade is likely to remain attractive enough for providers of foreign capital, especially considering the positive macro traction and improved credit ratings.

(BusinessDay)