Foreign investments into the Nigerian economy soared to its highest in at least two years on favourable returns buoyed by the Central Bank of Nigeria (CBN)’s jumbo rate hikes targeted at luring capital.

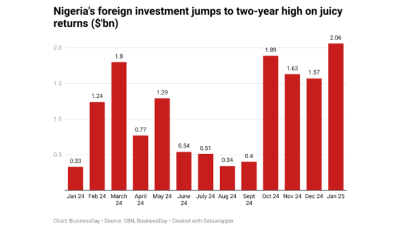

Capital inflows into the economy jumped from $0.33 billion in January 2024 to $2.06 billion in the corresponding month of 2025, marking a 524.24 percent increase in one year. Inflows stood at $1.57 billion in December 2024, representing a 32.12 percent rise month-on-month.

“Capital inflow increased due to favourable returns in the domestic financial market,” the CBN said in its monthly ‘Economic Report’ for January.

Foreign direct investment (FDI), on the other hand, declined to $0.07 billion from $0.12 billion in December 2024 as uncertainty of macroeconomic environment, infrastructural deficits and recurring security challenges slowed investors’ appetite for long-term stay.

‘Other investments,’ mainly loans, also decreased to $0.14 billion from $0.22 billion in the preceding month.

“In terms of share, portfolio investment inflow constituted 89.60 percent, while ‘other investment’ and direct investment accounted for 7.01 and 3.39 per cent, respectively.”

Portfolio investors acquire and manage an array of financial assets, such as stocks, bonds, and other securities, Investopedia says. Portfolio investors are mainly driven by high yields or returns or sentiments by way of major announcements.

Foreign investments in the Nigerian equities market stood at $150 million in the second quarter of 2024 (Q2 2024), marking a 204 percent increase from $49.4 million recorded in the first quarter (Q1), the National Bureau of Statistics (NBS) said.

They reached the highest level, post-COVID, in September 2024, hitting $284 million for the first nine months of 2024. This marked a 19 percent year-on-year appreciation from the $239.2 million recorded in the corresponding period in 2023.

Trade tariff impact

However, the CBN said that a series of ‘reciprocal tariffs’ triggered by President Donald Trump may reverse these gains as investors flee to safety to avoid taking a hit from the ripple effects of the levies, especially on emerging markets like Nigeria.

“There has been a partial reversal of foreign flows given the volatility in oil prices. This said, investors continue to acknowledge key fiscal and monetary reforms which have put the sovereign on a better footing,” said Samuel Sule, chief executive officer of Lagos-based Renaissance Capital Africa.

The Olayemi Cardoso-led CBN has maintained an orthodox monetary policy since his assumption some 18 months ago, raising benchmark interest rates by a cumulative 875 basis points to 27.5 percent in a key move to tame rising prices and allow capital inflows into Africa’s most populous nation.

These jumbo rate hikes saw FPI inflows increase as investors bet on Nigeria.

Banking leads share of capital inflows

A sectoral analysis showed that the banking sector was the highest recipient of foreign capital, accounting for 45.22 percent of total inflows. This was followed by the financing sector’s 44.32 percent, telecommunication’s 3.86 percent, production and manufacturing sector’s 3.01 percent, shares’ 1.57 percent, and trade’s 1.43 percent. Other sectors accounted for the balance.

Capital inflows by the originating country showed that the UK was the major source of capital, accounting for 65.65 percent of the total. This was followed by the United States at 8.15 percent; Republic of South Africa at 7.66 percent; United Arab Emirates at 7.18 percent; Mauritius, 2.87 percent; Belgium, 2.28 percent, among other countries.

The inflows by destination indicated that the Federal Capital Territory (FCT) was the highest recipient, with a share of 62.88 percent of total inflows. This was followed by Lagos at 36.59 percent; Ogun at 0.04 percent, and Kano at 0.01 percent. Other destinations accounted for the balance.

Loan repayments drive capital outflows

While foreign investments recorded its biggest jumps in recent times, capital outflows also increased in January 2025, driven by higher loan repayments and capital reversals.

According to the CBN, capital outflow rose to $1.20 billion, from $1.06 billion in the preceding month, as loan repayments and capital reversals increased by 27.45 and 3.85 percent respectively to $0.65 billion and $0.54 billion.

The report noted that repatriation of dividends, however, declined by 66.67 percent to $0.01 billion.

“In terms of share in total outflow, repayment of loans constituted 54.33 percent, followed by capital reversals and repatriation of dividends at 44.81 and 0.85 percent, respectively. Other forms of outflow accounted for the balance.” (BusinessDay $