The Billionaires and The Guru: How a Family Burned Through $2 Billion

Along the river Beas in North India sits a sprawling spiritual commune that’s somewhere between a traditional ashram and a Florida gated community. There’s a grand meeting hall with tiered spires and pearl domes, but also tract housing and an American-style supermarket. It’s home to 8,000 devotees of the Master: Gurinder Singh Dhillon.

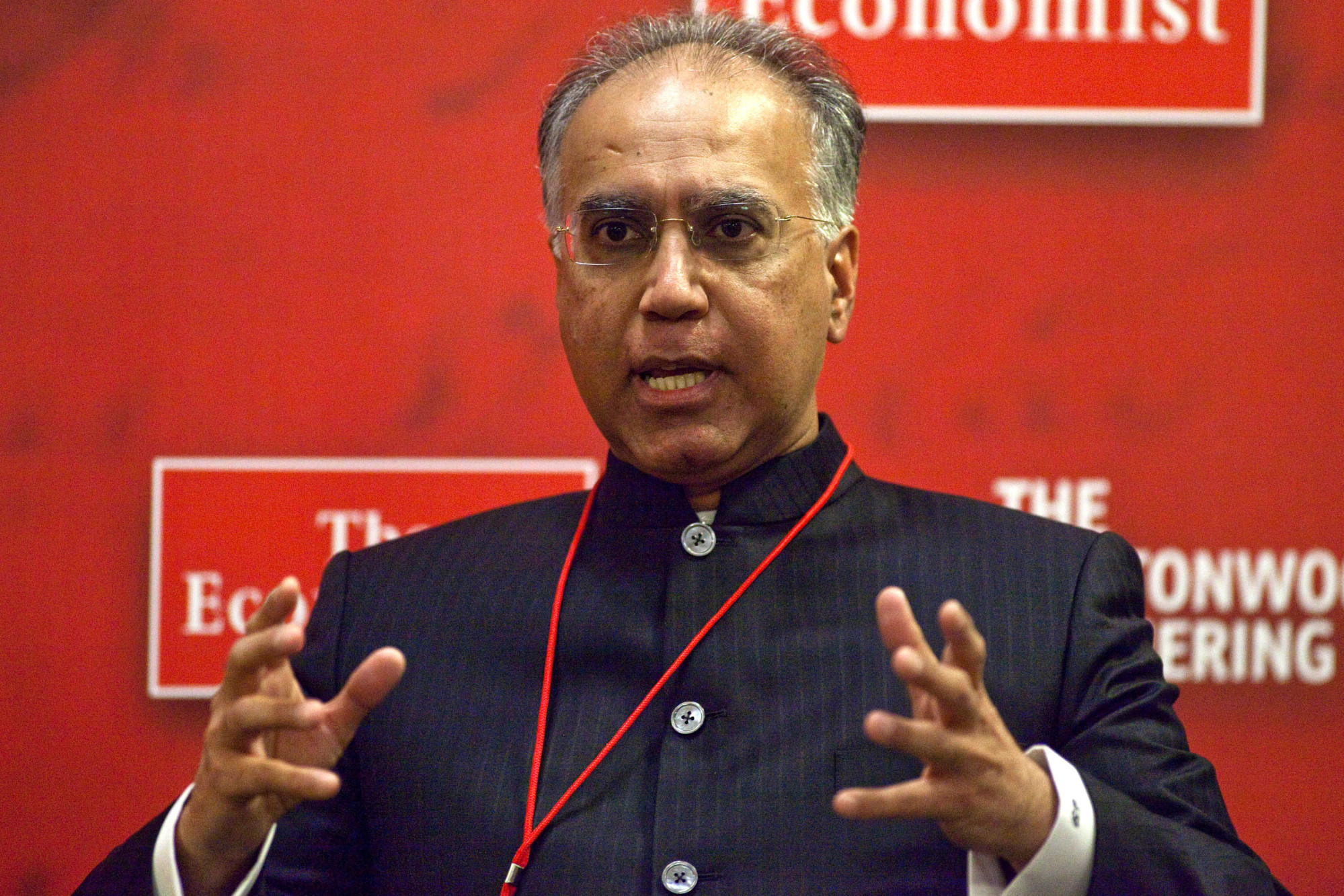

Malvinder Mohan Singh, left, and his brother Shivinder Mohan Singh at their residence in Gurgaon on Dec. 31, 2003. Source: The India Today Group/Getty Images

His group, the Radha Soami Satsang Beas, says it has more than 4 million followers worldwide. Many call him a God in human form. But in the secular world of money, Dhillon, 64, is a key character in one of the most dramatic collapses in the annals of Indian business: The unraveling of the financial and health-care empire owned by the Singh brothers, Malvinder and Shivinder.

Over the years, the brothers’ main holding company loaned about 25 billion rupees ($360 million) to the Dhillon family and property businesses largely controlled by them, according to documents and people familiar with the matter. Some of those outlays were financed with money borrowed from the Singhs’ listed companies, and when combined with other Singh investments gone bad threw their empire into a debt spiral, a Bloomberg News analysis of public records and interviews with 10 people familiar with the finances of both camps showed.

An aerial photograph of the Beas commune, as published in the Radha Soami Satsang Beas photographic album “Equilibrium of Love.”Source: Radha Soami Satsang Beas

Heirs to a generations-old business house once worth billions, the brothers have in the last six months seen a dramatic fall in their fortunes. They’ve had their public shareholdings seized by lenders. They’re under a criminal probe by financial authorities over 23 billion rupees missing from their listed companies. They owe $500 million over fraud allegations related to the 2008 sale of drugmaker Ranbaxy Laboratories. They’ve also lost the family mansion. Both deny any wrongdoing.

Dhillon is a cousin of the Singhs’ mother, and he became a surrogate father to them after the death of their own in the late 1990s. Since then, the finances of the spiritual leader and the brothers have grown intertwined, with money flowing from the Singhs to the Dhillon family via loans through shell companies and an array of arcane financial instruments, according to the documents and people familiar with the matter, who asked not to be named because of the ongoing legal probes. Dhillon hasn’t been accused of any wrongdoing.

The Billionaires and The Guru

All members of the spiritual commune, including the guru, are expected to support themselves financially, and the sect’s representatives said the Master’s business dealings are a personal matter separate from his role at the spiritual group.

The Singhs’ downfall comes as Prime Minister Narendra Modi pushes to increase transparency and attract more foreign investment to the world’s fastest growing major economy. But the brothers’ story is a cautionary tale to anyone doing business in India, offering a window into the opaque corporate structures common in the family dynasties that dominate Indian commerce.

“This opacity makes for risk,” said Arun Kumar, an economist with the New Delhi-based Institute of Social Sciences. “Legitimate business people may not want to come to India.”

Malvinder Mohan Singh shares a moment with Daiichi Sankyo Co.’s then CEO Takashi Shoda in New Delhi on June 11, 2008.Photographer: Gurinder Osan/AP Photo

The Singhs are famous for expanding their two public firms – hospital operator Fortis Healthcare Ltd. and financial firm Religare Enterprises Ltd.—at breakneck speed after reaping $2 billion from the Ranbaxy sale. Less known is the massive debt they took on to do so, all while they were financing a real-estate portfolio largely owned by their guru’s family.

Malvinder, 45, and Shivinder, 43, haven’t been charged with any crimes. The brothers acknowledge having financial ties to Dhillon, and in written comments said they are in dialogue with the Dhillon family and its companies to address the money owed to them.

But they also said it would be “untrue” to suggest that the guru was a cause of their group’s financial troubles. “Malvinder and Shivinder are unequivocal about this: Mr. Dhillon is their spiritual Master,” the brothers wrote. “He has only ever acted out of love and has only ever had their best interests at heart.”

They’re less generous to another follower of the spiritual group, Sunil Godhwani, whom they say was appointed to lead Religare at Dhillon’s recommendation. They say Godhwani was also in charge of their holding company, RHC Holding Pvt., and often took decisions without informing them. They say he was the architect of the financial structures, including the loans to the Dhillon family and companies, that led to their financial troubles.

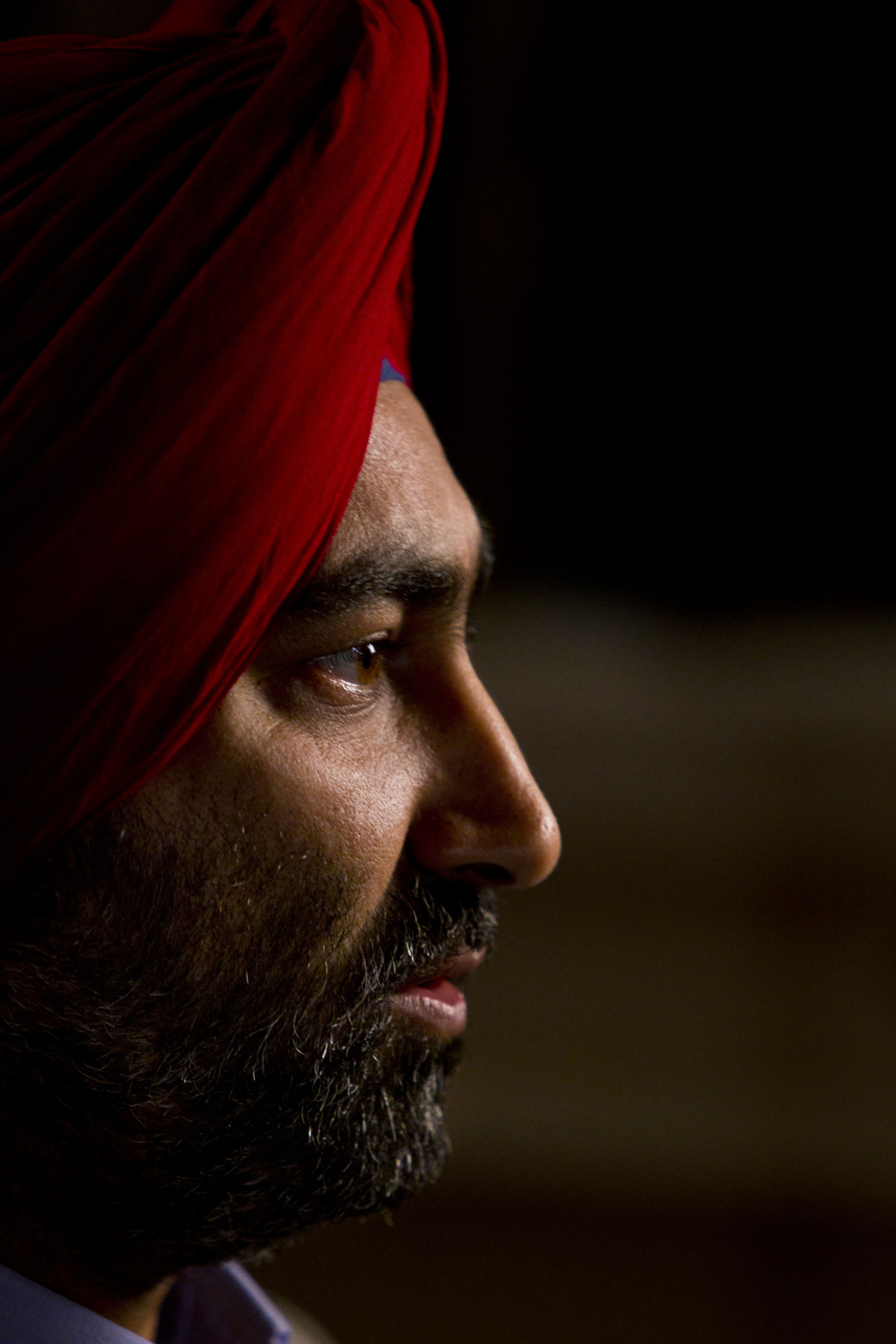

Sunil Godhwani in New York on Oct. 26, 2010. Photographer: Ramin Talaie/Bloomberg

Bloomberg News has been unable to independently verify the Singhs’ claims that Godhwani ran their holding company in the period between 2010 and 2016, when most of the major borrowing, loans, investments and routing of funds occurred. RHC says he was president there between 2016 and 2017. Godhwani declined to comment, and he left his role as chairman of Religare in 2016.

For his part, Dhillon also declined to be interviewed. A statement from J.C. Sethi, secretary of Radha Soami Satsang Beas, said Dhillon played a role helping the Singhs assert control of their father’s businesses following his death, and in guiding them after. But since 2011, ill health, including a battle with cancer, caused the guru to step back to focus on his spiritual duties, he said. “The Master can advise but he cannot make a choice for you,” he added.

Representatives for the spiritual group said the Master has no role in its administration or finances.

Earlier this year, Bloomberg News reported that the Singhs had taken 5 billion rupees from Fortis without board approval and that a New York investor had filed a lawsuit accusing the brothers of siphoning 18 billion rupees from Religare.

The Singhs say they didn’t do anything illegal. They say Godhwani was in charge of both Religare and RHC at the period in question. The movement of funds at Fortis were part of normal operations at the time, and only later became related-party transactions, according to the brothers.

India’s stock market and fraud regulators launched investigations into financial irregularities at both companies, although they are yet to report their findings. Both agencies didn’t respond to requests for comment.

A photograph of one of the hostels at the Beas commune, as published in the Radha Soami Satsang Beas photographic album “Equilibrium of Love.” Source: Radha Soami Satsang Beas

The Singhs’ rise as businessmen in their own right began in 2008, when they sold Ranbaxy, then India’s largest drugmaker, to Japanese pharmaceutical company Daiichi Sankyo Co. The sale occurred just as the U.S. Food and Drug Administration started raising questions about the Indian firm’s manufacturing practices and the safety of its drugs, although Ranbaxy denied the allegations at the time.

The brothers went on to use their cash reserves aggressively to build up Fortis and Religare—which would each top $1 billion in market value as India’s demand for health and financial services surged. They took their father’s place in Delhi high society among other old business families, becoming patrons of Indian artists and socializing at exclusive clubs.

Then in 2013, Ranbaxy pleaded guilty to criminal felony charges in the U.S. and faced $500 million in fines. In an arbitration tribunal in Singapore, its new owner, Daiichi Sankyo, accused the Singhs of concealing the extent of its regulatory problems during the sale. The Singhs say they didn’t conceal any information.

By that time, Dhillon was playing a big role in the Singhs’ finances. He was their “central father figure” after their own died in 1999, they wrote in their statement. Sect members held key positions in the Singh empire: One became chairman of Ranbaxy’s board, helping ensure Malvinder’s swift rise to the top. Another devotee, Godhwani, led Religare.

The Dhillon family would eventually become Religare’s second-largest shareholder, after the Singhs, with money lent to them by the brothers, according to people familiar with the matter. Godhwani consulted with Dhillon regularly on Religare, as would the Singhs on Fortis, the people said.

In 2015, the younger brother, Shivinder, briefly took a hiatus from the business to work at the spiritual group full time.

Shivinder Mohan Singh at his residence in Gurgaon on April 4, 2014. Source: Hindustan Times/Getty Images

A photograph on the sect’s website shows Dhillon with a white beard, white turban and flowing white tunic. But several people who know him say he’s fond of self-deprecating jokes, and in private is more charismatic everyman than ethereal mystic.

As many as 500,000 devotees sometimes visit the ashram at once to listen to his teachings of how meditation, vegetarianism and high moral values can help one escape the cycle of death and rebirth.

He emphasizes community service. On a recent Tuesday at the commune, a battalion of women volunteers sat at giant wood-fired griddles, making chapatis, the Indian flatbread. Some days they roll out more than 80,000 an hour to feed hungry pilgrims.

Still, Dhillon hails from a family of major landowners in Punjab, and was himself a businessman in Spain prior to his ascension at the spiritual group. So he took an active interest in the Singhs’ holdings, the people said.

“I think he’s a businessman in his mind first, and a guru second,” said Brian Hines, an American who was a member of the sect’s U.S. community for 35 years and has visited Beas. He now blogs critically about it, having since left.

By 2010, another business opportunity emerged. Towns outside India’s capital, New Delhi, were experiencing a property boom that was turning farmers into millionaires. The Singhs’ resources were marshaled to help the Dhillon family build a real-estate empire.

Two companies, Prius Real Estate Private Ltd. and Lowe Infra and Wellness Private Ltd., were set up by people close to the guru, and although partly hidden by layers of shell companies, the Dhillon family had ownership interests in both, people familiar with the matter said and filings show.

Over the next two years, these firms together received about 20 billion rupees in zero-interest loans from the Singhs’ private holding company or its subsidiaries, according to the people and the documents. Funds were then disbursed to other companies controlled by the Dhillons. The Singhs owned a 51 percent stake in Lowe.

These loans proved costly to the Singhs, coming on top of other major financial commitments that were underway. From 2011 onwards, the brothers’ holding company went on to sink at least 12 billion rupees to cover losses at their investment banking venture Religare Capital Markets Ltd. Other loans went to Ligare Voyages Ltd., a money-losing charter airline.

Malvinder Mohan Singh during an interview in Bangkok on May 30, 2012. Photographer: Brent Lewin/Bloomberg

The Singhs’ holding company also loaned at least 7 billion rupees to cover losses at a firm that had been spun out of Religare to manage the financial firm’s administrative costs. The loss-making firm’s biggest expense was rent, much of which was paid to buildings owned by the guru’s family, according to documents and people familiar with the matter.

In some cases, Religare had no use for all the space it was leasing from the guru’s buildings and large parts sat empty, the people said and internal documents show.

RHC, the holding company, also made personal loans of 5 billion rupees to Dhillon family members, via a network of shell companies, people familiar with the matter said.

The Singhs funded all these outlays to the guru’s businesses and to their own ventures with borrowing. And a substantial portion came from Fortis and Religare, often through the same network of shell companies used to lend to the guru’s family, people familiar with the matter said.

Taken together, the zero-interest loans to Dhillon firms and Singh investments gone bad created a crushing debt load that required even more borrowing to service. Their total borrowings hit about $1.6 billion by March 2016, filings show.

As things deteriorated, funds at the two primary public companies controlled by the Singhs, Fortis and Religare, were continuously routed back and forth via shell companies to deal with cash shortages elsewhere in the Singh family empire, according to multiple people familiar with the matter.

Then came the final blow. In 2016, the Singapore tribunal sided with Daiichi Sankyo in its long-running suit against the brothers, awarding the Japanese firm about $500 million in damages and interest. The Singhs are appealing the ruling. But with the added liability, outside lenders to the brothers were reluctant to keep the taps open, even as the brothers offered up their family home and company shares as collateral.

How the Money Moved

Sources: Ministry of Corporate Affairs, RHC Holding, Bloomberg reporting

Note: Monetary values are investments and loans since 2009.

By 2016, they couldn’t pay back the latest in the series of loans that had been going in and out of Fortis for four years, which amounted to about 5 billion rupees. When India’s central bank discovered 18 billion rupees taken from Religare had gone to subsidiaries of the Singhs’ main holding company, it demanded it be paid back, but it still hasn’t been.

Finally, banks seized assets backing their loans, including the majority of their shares in Fortis and Religare. They had to sell the home they grew up in to pay back another lender. The Singhs have said they are working to resolve issues with stakeholders.

Minority shareholders took over at Religare. A bitter takeover battle kicked off for Fortis and Malaysia’s IHH Healthcare Bhd in July agreed to take control of the hospital operator.

The New Delhi property boom Dhillon’s family companies invested in has since gone bust. And those real-estate companies have their own debt beyond what was lent by the Singhs, according to people familiar and documents.

An aerial view of the Beas commune, on May 18, 2016. A solar plant can be seen top right.

Photographer: Barcroft Media/Getty Images

Between personal loans and complicated company structures, it’s hard to tell exactly how much Dhillon still owes his nephews and what assets they still hold. For the Singhs’ other lenders, Daiichi Sankyo, or law enforcement seeking penalties, recovering this money from the Singh empire may depend on the terms of arcane debt securities, which aren’t public and can be changed with the consent of both parties.

Complicating matters is that ancient ties of clan and religion are hard to shake in India. Asked what the Singh brothers would do for their Master, one person who knows the family answered in one word: “Anything. (Bloomberg)