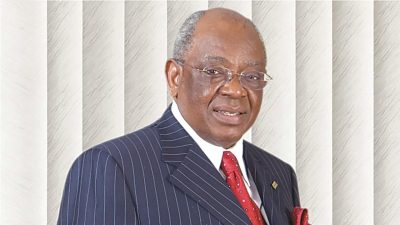

Tribute to Subomi Balogun, the entrepreneurial banker, By Femi Otedola

I pray that the new generation of bankers will learn from their doyen and more clearly understand the linkages between financial transmissions and the economy. Banks cannot thrive without genuine entrepreneurs and entrepreneurs cannot accelerate growth without the leverage of supportive banks.

Otunba M. O. Balogun (CON) was a father figure to me, based on his longstanding friendship with my late dad, Sir Michael Otedola, and also his supportive disposition to entrepreneurs who are sincere and committed.

At the height of the global financial meltdown between 2007 and 2009, my businesses, especially in the downstream oil and gas industry, had diesel stock, which was bought for $800,000,000 (eight hundred million dollars) at $147 per barrel, collapsed to the price of $33 per barrel. The business nose-dived and bankruptcy stared me in the face, raising my heart pulse, practically killing my sleep and pushing me to the edge of suicide.

All around me were financial institutions trying to recover their loans before what they thought would be the inevitable crash of my businesses. I looked up and said, “God Almighty, there is always Hope but where will it come from?” It came through two truly distinguished top brass bankers, who understood real entrepreneurship: Otunba M.O. Balogun was one of them; the other was Tayo Aderinokun, both now of blessed memory. Otunba took the view that before the global meltdown, my businesses were punctual with all debt servicing, leaving surplus funds in banks, and he believed in me that with support across the meltdown, I can bounce back.

He back-stopped his belief in me with his conviction that I will not risk the integrity of Sir Michael, who was his close friend. On his weekend trips to Ijebu Ode, he started making brief detours to see Sir Michael at Epe. Although he did not discuss the matter of unpaid loans with him, but he would tell me that, “I saw your dad at Epe on my way to Ijebu Ode”. I got the message: I must do everything possible to solve this problem, so that I don’t get my dad to know. Looking back, I wonder whether other borrowers in similar situations came under the pressure of pedigree. You may argue that pedigree is not collateral but trust me, it worked in my case as a strong force for good corporate behaviour.

I thank God, Otunba, Tayo and a few others supported my bounce back, earning me a treasure trove of hard experiences.

After the death of Sir Michael, I gravitated towards Otunba for counsel during trying situations or the need to take critical decisions. He usually will start by holding my hands and leading me to his kneelers for prayers.

When it started becoming clear that the worse was over, and that my bounce back was possible, even imminent, Otunba paid me an unscheduled visit, from his office at Primrose Tower, by Tinubu Square, to my office in AP on Marina. I rode the lift to the ground floor with him, only to discover that he had walked to my office. I had no choice but to walk him back to his office. During this walk, he said to me, “Femi, time is very crucial because before you know it you are old”; this simple, even obvious fact, has stuck to me and enhanced my time-consciousness.

I pray that the new generation of bankers will learn from their doyen and more clearly understand the linkages between financial transmissions and the economy. Banks cannot thrive without genuine entrepreneurs and entrepreneurs cannot accelerate growth without the leverage of supportive banks.

After the death of Sir Michael, I gravitated towards Otunba for counsel during trying situations or the need to take critical decisions. He usually will start by holding my hands and leading me to his kneelers for prayers.

In the whole process, I became a mentee of Otunba and he encouraged his children to see me as their elder brother, friend and business associate.

I am indebted to him and pray for the peaceful repose of his great soul.

Femi Otedola, a businessman is chairman of Geregu Power Plc.