Business

Bigger than Dangote? How BUA Foods became Nigeria’s hottest stock

When BUA Foods was admitted to the Nigerian stock exchange on 5 January 2022 with a market capitalisation of N720bn, Dangote Cement held the top spot with a N4.26trn valuation, followed closely by MTN Nigeria Communications and Airtel Africa.

Since then, the company has worked its way up from eighth to first position, overtaking MTN on 7 August as its valuation crossed the N10trn mark for the first time.

Its market cap hit N11.33trn as of 24 September, accounting for 12.72% of the total value of listed equities on the Nigerian Exchange Limited (NGX).

The company is part of BUA Group, a conglomerate founded and chaired by billionaire tycoon Abdul Samad Rabiu with interests in several sectors including cement and real estate.

BUA Foods emerged in 2021 following the consolidation of the group’s food businesses in sugar, rice, edible oils, flour and pasta.

It also surpassed its sister subsidiary BUA Cement, whose market cap stood at N5.14trn on Wednesday, compared to N2.37trn on 5 January 2022.

Its stock has gained about 52% so far this year in terms of price and valuation, higher than the broader market’s year-to-date return of 36.92%.

New mills, silos, others to be launched soon

Speaking with The Africa Report, BUA Group Chairman and CEO Rabiu, who also chairs BUA Foods, points out that the food business delivered N1.53trn in revenue last year, with net income and dividend rising more than twofold.

“That strength underpins our confidence,” he says.

Flour and rice are the near-term growth drivers, while sugar integration is “a longer cycle and a critical investment for Nigeria’s food security”, he says.

“We are commissioning new mills, silos, and logistics assets in Q4 2025 and Q1 2026,” he says.

“This will temporarily squeeze margins, but that is intentional. We are building capacity ahead of demand.”

The tycoon says that by 2027, the assets will stabilise margins and deepen the company’s market position into “the all-round market leader in Nigeria”.

The company insists on a 15–20% return on invested capital as its minimum threshold, with 4-6 years payback, according to Rabiu, who says: “discipline underpins both growth and shareholder returns”.

He says the company has already invested over $250m in its 20,000-hectare Lafiagi plantation under development in Kwara State, including the 20-million-litres-per-annum integrated ethanol plant.

“The critical need is policy stability, which we are beginning to see under this new administration.

“Long-cycle investments cannot succeed if policy changes unpredictably,” he says.

“When rules are steady, capital will continue to flow. Our long-term commitment to sugar is strategic for us, and we are building for Nigeria’s self-sufficiency.”

Improved fundamentals

Nabila Mohammed, an equities analyst at Lagos-based Chapel Hill Denham, attributes the rally in BUA Foods stock to the company’s improved fundamentals and low free float.

“It is largely because the company has done so well,” she tells The Africa Report.

“For companies that have low free float such as BUA Foods and Dangote Cement, if they do well fundamentally – that is, in terms of their performance metrics, it always translates to them rallying significantly.”

BUA Foods’ free float stood at 5.02% as of 30 June 2025, up from 4.73% in December, with a value of N390.44bn, which is compliant with the NGX requirements, according to data from its financial statements.

The company’s profit after tax more than doubled last year to N265.99bn from N112.09bn in 2023.

Its stock also gained over 100% as the market cap increased to N7.47trn from N3.48trn.

Its dividend payment to shareholders was increased by 136% to N13 per share for last year.

“Investors will reward a stock accordingly, based on how much it returns to them in terms of dividends and sustains strong performance,” Mohammed says.

Becoming innovative

She points out that the fast-moving consumer goods sector, in which BUA Foods is a major player, has had to contend with several economic headwindssuch as surging borrowing costs that saw them deploy strategies that would support their performance.

“Most of them became very innovative. We started to see them bring out new product variants and embark on backward integration just to support their margins and sustain their revenue performance through the tough times.

“Some of them did price increases across their products; some of them started to diversify their energy sources,” she says.

BUA Foods was one of the companies hardest hit by the devaluation of the naira in 2023 and 2024, as it reported forex losses of N81.86bn and N173.29bn, respectively.

Its managing director Ayodele Abioye said in January that the business navigated the impact of “significant macroeconomic challenges” on supply chain costs and forex losses last year, adding that its expansion strategy enabled its capability to fulfil increased customer demand and enhanced operational efficiencies.

The company swung to a forex gain of N406.99m in the first half of 2025 from a loss of N54.67bn a year earlier, while its after-tax profit jumped to N139.7bn from N76.83bn.

A market mover

The Nigerian stock market soared to a 15-year high in 2023, ending with a return of 45.90%, more than double that of the previous year.

The rally has continued since then, although at a slower pace in 2024 when equities gained 37.65%, data compiled by The Africa Report shows.

Industry analysts attributed the rally to government reform efforts that revived investor confidence, improved business fundamentals, new listings and the ongoing bank recapitalisation.

BUA Foods is one of the few market movers on the bourse, with its share of total market value soaring to 12.72% from 3.38% in less than four years.

“If BUA Foods’ share price drops, it means the entire market will bleed if other large-cap stocks do not perform well. It now looks like wherever the stock moves, the market moves with it,” Mohammed says.

“If it continues to trend upwards, it is going to be positive for both the market and the investors.”

Other large-cap stocks are Dangote Cement, MTN and Airtel Africa, which were each worth about N8.7trn.

“Looking ahead with optimism, coupled with stability in the macro-economic environment, we would continue to focus our operations and strategic investment initiatives towards addressing food supply challenges,” Abioye, who took the helm of BUA Foods in 2021, said in a recent earnings release.

“We aim to deliver a strong performance with sustained value creation for all stakeholders in line with our north-star objectives.”(The Africa Report)

-

News3 hours ago

News3 hours agoDIG Mba, others retire, seven AIGs for promotion

-

News4 hours ago

News4 hours agoDetention: El-Rufai Petitions ICPC, Demands N15.6bn Damages

-

News3 hours ago

News3 hours agoBorno: Hundreds still missing after Boko Haram attack

-

World News22 hours ago

World News22 hours agoHow Iran Strikes Have Damaged US Military Sites – CNN

-

Politics4 hours ago

Politics4 hours agoTinubu Elevates Masari To Special Adviser

-

Sports4 hours ago

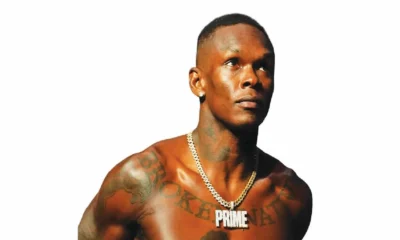

Sports4 hours agoAdesanya demands $15m per fight from UFC boss White

-

Business4 hours ago

Business4 hours agoMiddle East Crisis: We’ll Ensure There Is No Fuel Scarcity In Nigeria, Says Dangote Refinery

-

Uncategorized20 hours ago

Uncategorized20 hours agoJUST IN: Court acquits Abba Kyari of non-declaration of assets charge