Business

Govt may earn N1tr yearly from capital gains as new tax causes stir

• Nigeria imposes highest capital gain tax in Africa

• Market at risk of short-term share dumping

• Imposition may slow growth momentum, experts warn

The government may realise as much as N1 trillion yearly from the proposed 30 per cent tax on capital gains, The Guardian has learnt. This could rise further if market activities continue to leap geometrically as seen this year.

Last year, the estimated value of shares traded was N2.8 trillion. Matched against the yearly capital gain of 34.15 per cent in the period, the government could earn N286.8 billion in capital gain tax.

The Nigeria Exchange (NGX) all-share index experienced a total return of 37.65 per cent in 2024, comprising both capital appreciation and dividends.

Given that the average dividend yields in the Nigerian equities market stood at 3.5 per cent in 2024, the capital gain stood at 34.15 per cent, which could be estimated at N956.2 billion in the case of last year.

The CGT, as proposed in Section 34 of the Nigeria Tax Act, would apply to the figure. At a rate of 30 percent, investors would pay N286.8 billion in tax to the government.

In the first quarter alone, the latest data by the NGX revealed that the value of total traded equities in the first half of 2025 (H1) surged to N4.19 trillion, surpassing the N2.8 trillion achieved in the entire 2024.

If the market activities continued at the same level through the year, the value of transactions could reach N8.4 trillion at the close of the year.

If the year-to-date capital gain is sustained at the current year-to-date capitalisation gain of 39.5 per cent, the capital gain for the year could hit N3.3 trillion. This would dramatically push the CGT windfall from this year’s trading to N995 billion.

The figure is nearly four times what could have accrued from the tax last year, suggesting that going into the figure, the CGT may become a major budget financing item.

The rising volume of share disposals reflects growing investor activity and confidence in the Nigerian equities market.

However, analysts warn that a steep CGT, if implemented without adequate exemptions or a phased structure, could undercut the market growth momentum.

With a higher base value like N8.2 trillion, the financial impact on institutional and high-net-worth investors becomes more pronounced, and the risk of capital flight or portfolio reallocation into less-taxed or tax-exempt instruments becomes real.

The evolving scenario further fuels concerns that the proposed tax, though potentially beneficial for fiscal consolidation, might come at a significant cost to investor appetite and market growth.

Analysts, operators and investors have criticised the move, which is expected to take effect in January 2026, describing it as a disincentive to investment and capable of putting equities at a competitive disadvantage.

According to them, the uncertainty and ambiguity surrounding the tax law present an even more immediate concern. They argued that while government revenue is important, policies must be balanced, predictable and just, especially in a market as sensitive and strategic as equities.

Without clarity and a sense of fairness, coupled with regional alignment with neighbouring markets, the CGT risks restricting rather than fostering the growth of Nigeria’s economic and capital market.

The new CGT regime includes a provision that allows investors an annual exemption of N150 million to shield 99.9 per cent of retail investors. However, many believe the implementation would put considerable pressure on the NGX until the end of the current year as both domestic and foreign institutional investors rush to realise gains under the existing tax framework before the new tax rules take effect.

Investigations by The Guardian revealed that with the new CGT, Nigeria will stand out for having the highest rate among its regional peers, compared to Ghana’s 15 per cent and Kenya’s zero per cent on listed securities. Morocco charges 10 per cent CGT while Egypt, another regional economic rival, abolished its earlier 10 per cent imposition in June.

This glaring disparity would ultimately threaten Nigeria’s ability to attract and retain much-needed capital in the equity market and discourage precisely the sort of long-term, productive investment the country urgently requires to deepen and stabilise the capital markets.

President of the New Dimension Shareholders Association of Nigeria, Patrick Ajudua, raised deep concerns over the proposed 30 per cent CGT on the Nigerian stock market, warning that it could significantly harm investor confidence, stall reinvestments, and undermine Nigeria’s competitiveness in the regional investment landscape.

According to him, while the current law allows investors to defer CGT if they reinvest earnings into equivalent securities, it lacks a clear definition of what qualifies as a reinvestment. He pointed out that this gap creates serious complications, noting that investors could unexpectedly find themselves liable for taxes when they move assets, even when doing so with the intention of reinvesting.

For institutional investors, especially, he said this lack of clarity could slow down reinvestment decisions, create unnecessary delays, and reduce confidence in Nigeria’s financial markets.

In addition, he stated that the absence of predictability and accuracy makes long-term portfolio planning difficult, particularly for large-scale investors managing retirement funds, insurance pools, or foreign capital.

Similarly, an independent investor, Amaechi Egbo, criticised the potential retroactive application of the tax, arguing that taxing capital gains based on the historical cost of an investment penalises gains that were accumulated before the law came into force.

“For instance, if an investor bought shares at N10 in 2018 and plans to sell them at N40 in 2026, they would be taxed on the N30 gain, despite the majority of that gain accruing years before the new tax was proposed.”

Egbo warned that this backwards-looking taxation method violates basic principles of fairness and legal predictability. He called for clear protection for prior gains, noting that without it, investors will see the market as unpredictable and hostile, which would further diminish their willingness to invest.

He cautioned against any policy that might breach regional treaties or integration efforts aimed at improving capital flows and investment coordination across African markets.

Egbo categorically stated that Nigeria should be working to enhance the integration and penetration of its market within the broader African investment ecosystem.He pointed out that imposing one of the highest CGT rates on the continent directly undermines these goals.

This, according to him, sends a message that the country is a less favourable investment destination compared to regional peers, and may prompt capital to flow into more tax-friendly markets, thereby weakening the domestic financial system.

Also contributing, Vice President of Highcap Securities, David Adonri, said the reintroduction of CGT on capital market transactions, especially at such a high rate, could pose a serious disincentive to investment in Nigeria’s already fragile equity market.

He explained that for an emerging and developing economy like Nigeria, which is in urgent need of attracting both local and foreign investment to stimulate capital formation and economic expansion, imposing additional taxes on investment activity may be counterproductive.

Adonri noted that the equity market is a critical engine for mobilising long-term funds needed for infrastructure development, industrial growth, and job creation.

He argued that introducing a heavy tax burden on gains realised from share disposals sends a negative signal to potential investors, who may begin to reassess Nigeria’s attractiveness as a destination for long-term capital.

In addition, he warned that while the government’s pursuit of increased tax revenue is understandable given fiscal pressures, policies targeting investment must be handled with extreme caution.

Adonri also described the 30 per cent CGT as a ‘market-unfriendly policy’ that could dampen investor sentiment, reduce trading activities, and ultimately undermine the vibrancy of the Nigerian capital market.He maintained that such a high rate of taxation on investment returns is rarely seen in economies that are actively seeking to deepen their capital markets and foster inclusive growth.

Beyond the immediate financial implications for investors, Adonri emphasized the psychological and strategic risks associated with the tax.

He noted that investor confidence is often built on trust, predictability and a favourable policy environment.

“Sudden or harsh policy changes, particularly those that affect returns on investment, can unsettle markets and lead to capital flight. In the case of the Nigerian market, which is already grappling with macroeconomic instability, inflationary pressures, currency volatility, and liquidity challenges, the imposition of a 30 per cent CGT could become yet another deterrent.”

He called on policymakers to critically re-examine the proposal, urging the federal government to weigh the long-term consequences of such a tax against the short-term fiscal gains it may generate.

Adonri believed that a more balanced and investment-friendly approach would better serve Nigeria’s development objectives, especially at a time when the country is striving to position itself as a regional financial hub.

He further stated that the policy, in its current form, should be reviewed to avoid stalling the progress made so far in building a resilient and attractive capital market. (Guardian)

-

Business19 hours ago

Business19 hours agoOil Industry Contracting: NCDMB Issues NCEC Guidance Notes, Rules Out Transfer of Certificate

-

News19 hours ago

News19 hours agoKnocks For Tinubu For Attending Wedding Without Visiting Kwara Massacre Victims

-

Politics19 hours ago

Politics19 hours agoMakinde, Wike camps set for showdown at PDP HQ today

-

News19 hours ago

News19 hours agoElectoral Act standoff: Senate calls emergency plenary as protests loom

-

Business19 hours ago

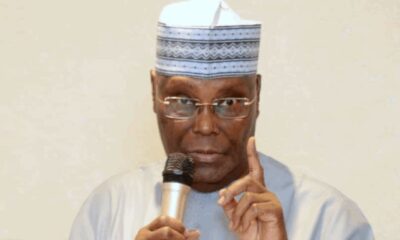

Business19 hours ago‘Should have been sold before rehabilitation’ — Atiku asks NNPC to discontinue proposed refinery deal

-

News19 hours ago

News19 hours agoInsecurity: ADC Spokesman Taunts Tinubu, Says Nigeria Has No Gov’t

-

News19 hours ago

News19 hours agoAbia blames typo after allocating N210m for photocopier in 2026 budget

-

News19 hours ago

News19 hours agoIdle refineries gulp N13tn as NNPC admits waste