Business

Aliko Dangote to sell 10% stake in refinery on NGX, targets 1.4m bpd capacity

Aliko Dangote, the founder of Dangote Group, says Dangote Petroleum Refinery plans to sell 5 percent to 10 percent of its stake on the Nigerian Exchange (NGX) Limited within the next year.

Speaking in an interview with S&P Global on October 20, Dangote said the move will mirror the approach adopted for Dangote Cement and Dangote Sugar Refinery.

“We don’t want to keep more than 65%-70%,” Dangote said.

He added that the shares would be offered gradually, depending on investor appetite and market depth.

The billionaire also said the group is considering strategic partnerships with Middle Eastern companies to support the refinery’s expansion and the development of a new petrochemicals project in China.

“Our business concept is going to change. Now instead of being 100 percent Dangote-owned, we’ll have other partners,” he said.

Dangote said the Nigerian National Petroleum Company (NNPC) Limited could increase its stake in the refinery after reducing its interest to 7.2 percent, but not until the next phase of the project’s growth is fully underway.

“I want to demonstrate what this refinery can do, then we can sit down and talk,” the group president said.

Also, the refinery announced plans to increase its output to 1.4 million barrel per day (bpd), a scale that would surpass the world’s largest 1.36 million bpd refinery in Jamnagar, India.

“In July, Dangote unveiled plans to expand the refinery from its current 650,000 bpd to 700,000 bpd by the end of the year,” S&P Global said.

“Now, the target is to reach 1.4 mbpd, with no specified date, a scale that would surpass the world’s largest 1.36 mbpd refinery in Jamnagar, India.”

Furthermore, Dangote said the company is also developing linear alkylbenzene and base oils projects and aims to increase polypropylene production from 1 million metric tonnes to 1.5 million metric tonnes annually in the coming years.

Speaking on the refinery’s residue fluid catalytic cracker (RFCC) maintenance plans, Dangote acknowledged that while most of the technical issues had been resolved, a few still lingered.

“We have resolved most, not all, but most of the problems. And I think we’re looking for a window when we shut down for another month,” the industrialist said.

He added that the planned turnaround would be carefully scheduled to avoid clashing with the year-end surge in fuel demand.

‘COMPANY’S REORGANISATION ALMOST COMPLETE’

Commenting on the dismissal of 800 staff members, Dangote said the refinery’s reorganisation was nearly complete and had helped ease recent tensions with labour unions.

“We don’t have any worries with the unions,” he added.

The group president also said production from the company’s upstream assets in the Niger Delta — oil mining leases (OML) 71 and 72 — is expected to begin this month, with output projected to reach up to 40,000 barrels per day.

The businessman added that while the group remains open to new upstream opportunities, the focus for now is on consolidating ongoing projects.(The Cable)

-

News17 hours ago

News17 hours agoMajor, 3 Soldiers, Hunter Killed In Borno

-

News17 hours ago

News17 hours agoUmrah Suffers Setback As Airlines Suspend Flights To S/Arabia

-

Politics17 hours ago

Politics17 hours agoAtiku’s son resigns from Fintiri’s cabinet

-

News17 hours ago

News17 hours agoRevised Executive Order: FG adjusts oil revenue remittance framework

-

News17 hours ago

News17 hours agoPolice Council Confirms Disu As IG, To Be Sworn In Wednesday

-

Politics17 hours ago

Politics17 hours agoDSS arrests social media user who ‘threatened’ Peter Obi after Edo attack

-

Business17 hours ago

Business17 hours agoPrivate jet flight from Riyadh to Europe now cost N479m as elites flee Middle East tensions – Report

-

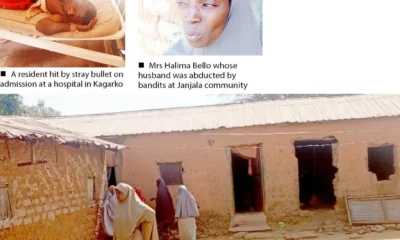

News17 hours ago

News17 hours agoVigilante, Wife, 12 Others Abducted In Kaduna