Business

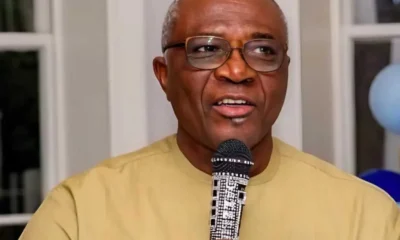

Fuel Tax on Hold Until Naira Strengthens and Oil Prices Fall — Oyedele Tells Nigerians

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, states that the proposed 5% fuel surcharge will not be implemented until key economic conditions improve, specifically a stronger naira or a decline in global crude oil prices.

Speaking at the Haulage and Logistics Magazine Conference and Exhibition in Lagos, Oyedele explained that although the levy is a sound policy aimed at funding road maintenance, introducing it now would further burden Nigerians already struggling with high living costs.

He noted that the surcharge, first introduced under former President Olusegun Obasanjo, was designed to channel a portion of fuel revenue to road repairs, with 40% allocated to federal roads and 60% to state and local government roads.

“The idea is brilliant and is already being implemented in more than 150 countries,” he said, pointing out that most of Nigeria’s estimated 200,000 kilometres of roads are in poor condition.

He revealed that the Federal Roads Maintenance Agency (FERMA) had pushed to begin collecting the levy after fuel subsidy removal, but the committee rejected the move.

“We said no—introducing such a tax now would be insensitive,” he said.

Oyedele explained that while the surcharge appears in the draft tax law, it cannot take effect unless the Minister of Finance issues an official order, a safeguard built into the reform framework.

“For me, the right time will be when the naira strengthens or crude prices drop, so the surcharge won’t raise pump prices,” he said.

He also assured stakeholders that the ongoing tax reforms will reduce costs in the haulage and logistics sector by eliminating multiple taxation and improving operational efficiency.

“We are not introducing new taxes; we are removing duplicated ones that frustrate transporters and inflate prices,” he stated.

Under the new policy, small transport and logistics firms with annual turnover below N100 million will be exempt from company income tax, and eligible operators will receive VAT refunds and other incentives.

Oyedele added that the reforms aim to simplify Nigeria’s complex tax structure and ensure transparent and efficient sharing of revenue across all tiers of government.

-

Politics4 hours ago

Politics4 hours agoN600bn war chest can’t save Fubara in 2027 – Wike

-

Business24 hours ago

Business24 hours agoInside Cyril Ramaphosa’s fortune: the McDonald’s deal, Mondi, Standard Bank ties, coal, telecoms and the trusts that followed

-

News4 hours ago

News4 hours agoTax laws: Court okays Jan 1 take-off amid protests

-

News3 hours ago

News3 hours agoAnthony Joshua discharged from hospital

-

News20 hours ago

News20 hours agoBREAKING: Peter Obi officially joins ADC

-

Opinion3 hours ago

Opinion3 hours agoIn saner climes: The phrase Nigerians reach for when things fall apart

-

Politics3 hours ago

Politics3 hours ago‘You Failed As Anambra Governor’ – Presidency Slams Obi

-

News3 hours ago

News3 hours agoObasa’s ouster, Benue speaker’s suspension — state assemblies gripped by crisis in 2025