Business

Pension fund soars to N26tn

Nigeria’s pension fund assets recorded 22.03 per cent growth as of the end of the third quarter, as they rose by more than N4.71tn, with Pension Fund Administrators deepening their allocation to Federal Government securities, according to the latest monthly data released by the National Pension Commission.

The figures, contained in PenCom’s latest Monthly Industry Report, indicated that total pension assets increased from N21.38tn in September 2024 to N26.09tn in September 2025, marking a robust year-on-year expansion of the Contributory Pension Scheme.

The PUNCH reports that Nigeria’s pension fund assets surpassed the N25tn threshold in July when they closed at N25.79tn. The upward trend continued in August as the funds rose by about N97.88bn to N25.89tn.

The monthly report revealed that Federal Government of Nigeria securities, comprising bonds, Sukuk, treasury bills, and agency securities, remained the dominant asset class for PFAs, accounting for roughly 60 per cent of total pension assets.

Between September 2024 and September 2025, PFAs increased their exposure to FGN securities by about N3tn, reflecting confidence in Federal Government instruments amid persistent macroeconomic uncertainties.

Beyond government instruments, pension funds significantly increased their participation in the equities market. PenCom’s documents showed that Domestic Ordinary Shares rose sharply by about N1.6tn year-on-year, driven by improved market valuations, increased liquidity, and strong investor sentiment.

Corporate debt instruments also received higher allocations, reflecting renewed activity in the corporate bond market and improved credit conditions for highly rated issuers.

On the count of Retirement Savings Accounts, the pension industry also recorded moderate growth, as RSA membership rose to approximately 10.9 million, supported by increased compliance enforcement, onboarding of new private-sector workers, and improved adoption of the rebranded Personal Pension Plan.

In recent times, PenCom has emphasised the need to deepen participation in the Contributory Pension Scheme, especially as it relates to the informal sector, which is where the PPP becomes instructive.

Recently, speaking at the Annual Conference of the Pension Correspondents Association of Nigeria, the Director-General, Omolola Oloworaran, said the revamped micro-pension framework is central to closing the country’s wide pension gap.

Oloworaran, who was represented by the Head of Corporate Communications, Ibrahim Buwai, said, “Nigeria’s informal workforce is estimated at between 70 and 80 million people, yet most have no structured retirement savings.”

She also bemoaned the fact that while artisans, traders, gig-economy workers, freelancers, and market operators power the nation’s economy, they remain outside formal pension protection. “For far too long, many of these individuals have had little or no access to structured pension arrangements,” she lamented.

The PenCom DG added that the commission was placing strong emphasis on digitisation to rebuild trust and reduce barriers in the PPP, which is aimed at deepening financial inclusion, mobilising long-term domestic capital, and securing dignified retirement outcomes for millions currently left out.

“Contributors receive instant acknowledgement of their contributions and have real-time access to their statements,” she said, adding that Pension Fund Administrators and Accredited Pension Agents would deploy mobile-friendly, technology-driven solutions to simplify onboarding.

She added that contributions under the PPP would be managed through a dedicated investment structure with conservative and growth options tailored to contributors’ preferences. (Punch)

-

News9 hours ago

News9 hours agoTinubu’s ambassador-designates in limbo

-

Business9 hours ago

Business9 hours agoCBN raises alarm over Nigeria fintech’s foreign reliance

-

Politics9 hours ago

Politics9 hours agoWe’ve no plans to impeach dep gov — Kano Assembly

-

Opinion9 hours ago

Opinion9 hours agoLeft behind but not forgotten

-

Politics9 hours ago

Politics9 hours agoWe Don’t Need Gov’s Support To Deliver Rivers For Tinubu – Wike

-

Politics9 hours ago

Politics9 hours agoElectoral Act: Amendment yet to be concluded – Akpabio tells critics

-

News9 hours ago

News9 hours agoKaduna Residents Protest Displacement Of 18 Villages By Bandits, Closure Of 13 Basic Schools

-

News9 hours ago

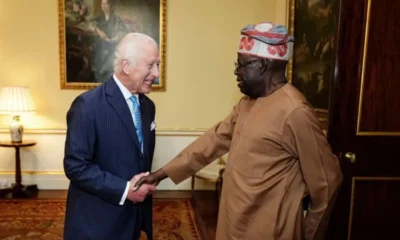

News9 hours agoTinubu Set For First UK State Visit In 37 Years