News

States, LGs repay N547.5bn bank debts

States and Local Government councils reduced their bank borrowings by about N547.52bn in one year, as Federation Account inflows surge, according to findings by Saturday PUNCH.

Figures from the Central Bank of Nigeria’s latest Quarterly Statistical Bulletin reveal that the banking sector’s “claims on state and Local Governments” fell from N2.68tn in June 2024 to N2.13tn in June 2025.

This means sub-national governments collectively cut their indebtedness to commercial and merchant banks by 20.4 per cent year-on-year.

Further analysis shows that in January 2024, banks’ exposure to states and councils stood at N2.73tn. One year later, in January 2025, the figure had dropped to N2.44tn, indicating that about N292bn was cleared during that period.

The outstanding balance then ticked up slightly in February 2025 to N2.59tn and eased again to N2.55tn in March 2025. By April and May 2025, exposure steadied around N2.44tn–N2.45tn, before a sharp decline to N2.13tn in June 2025, representing the largest single-month adjustment during the year.

Year-on-year, June provided the clearest shift. The banks were owed N2.68tn in June 2024, but the balance had fallen by more than half a trillion naira a year later.(Punch)

-

Politics10 hours ago

Politics10 hours agoAPC Congress: Ogun, Lagos Retain Chairmen, Ondo, Oyo Elect Babatunde, Adeyemo

-

News10 hours ago

News10 hours agoDSS Arrests Police, Immigration Officials ‘Implicated’ In El-Rufai’s Return To Nigeria

-

News23 hours ago

News23 hours agoBREAKING: Tinubu nominates Oyedele as finance minister

-

Sports11 hours ago

Sports11 hours agoRonaldo ‘Flees’ Saudi Arabia Amid Bombardment From Iran

-

News10 hours ago

News10 hours agoRivers Assembly unveils Fubara’s commissioner nominees

-

News10 hours ago

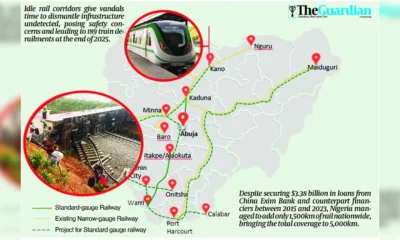

News10 hours agoFaulty design, vandalism, neglect endanger $3.4b rail overhaul

-

Business10 hours ago

Business10 hours agoBusinesses Bleed As Blackout Worsens

-

News10 hours ago

News10 hours agoFG suspends pilgrimages to Israel over Middle East security situation