News

Re-Gazetting Tax Laws Illegal – Lawyers

Senior Advocates of Nigeria (SANs) and other legal experts on tax matters have described the directive by the National Assembly to re-gazette the tax laws amidst allegations of alterations as illegal.

This is as the Nigerian Labour Congress (NLC), the Minority Caucus of the House of Representatives and the National Association of Nigerian Students (NANS) have again demanded suspension of the implementation of the tax laws planned to commence on January 1, 2026.

A member of the House of Representatives, Abdussamad Dasuki, had raised a matter of privilege in the House of Representatives, alleging discrepancies between the versions of the tax bills passed by lawmakers and the copies subsequently gazetted.

The four laws forming the tax reform framework are the National Revenue Service (Establishment) Act, the Joint Revenue Board of Nigeria (Establishment) Act, the Nigeria Tax Administration Act and the Nigeria Tax Act.

They were passed in March, with Votes and Proceedings produced in May, signed into law by President Bola Ahmed Tinubu in June, and gazetted on June 26, according to copies sighted by Daily Trust.

Following the allegations, the House set up a seven-member ad hoc committee to investigate and report within one week which elapsed last Thursday.

Responding to the calls from various quarters for suspension of the implementation of the tax laws, the National Assembly, last Friday, ordered re-gazetting of the tax laws; the move it explained is purely administrative and aimed at protecting the integrity of the legislative record.

It specifically directed the Clerk to the National Assembly to re-gazette the Acts and issue Certified True Copies (CTCs) of the versions “duly passed by both chambers of the National Assembly.”

‘N/Assembly lacks power to re-gazette laws’

Some lawyers, who spoke to Daily Trust yesterday, said the legislature lacks the powers to re-gazette the laws.

A legal practitioner, Liborous Oshoma, said re-gazetting the tax laws is not within the powers of the legislature.

“I think the National Assembly is overreaching itself. It should understand the scope of separation of powers. If a law, as passed by them, was uttered, what it means is that such a law was doctored. What was gazetted was different from what the National Assembly passed. And that is a serious criminal offence,” he stated.

He further said, “If the National Assembly is going ahead to gazette the laws by themselves, indirectly it is a vote of no confidence in the executive. What it means is ‘we don’t trust you enough to do the right thing.’ Instead of the National Assembly to openly pass a vote of no confidence on the executive over this issue, they are begging the question by telling Nigerians they would re-gazette the laws when they don’t even have the power to do so.”

Taiye Oniyide, SAN, raised concerns over what he described as procedural lapses surrounding the tax laws.

Oniyide said where an observation has been made and a committee set up to look into it, due process requires that such a committee should first conclude its assignment before any further steps are taken.

He said, “As we speak, it is not even clear whether that committee has submitted its findings. If the leadership of the House is already talking about re-gazetting the matter while the investigation is still ongoing, does that not amount to preempting the outcome of the investigation itself?

“Whichever way one looks at it, the entire process appears to be making a mockery of the system. Once a process reaches a stage where decisions taken raise serious procedural and even criminal concerns, including issues that could affect clarity and judicial interpretation, the entire exercise becomes questionable and inadvisable.”

The senior advocate argued that the most reasonable step in such circumstances would be to start afresh.

“The authorities ought to go back to the drawing board, re-examine the entire process and closely monitor it until it is properly aligned and improved. That is what should be done,” he said.

He also questioned the motive behind the insistence that the policy must proceed at all costs, particularly amid public opposition.

“Is this an attempt to force implementation regardless of public reaction? Such an approach presupposes a prejudiced mindset. If the solution is to return to the starting point, why then the sudden rush to re-gazette by January?” Oniyide queried.

He described the urgency as “suggestive of auxiliary motives that are clearly not in the interest of the average Nigerian.”

Another SAN, Kunle Rasheed Adegoke, said, “The National Assembly is not re-gazetting the law. That term is incorrect and a mischaractisation. What the legislature is doing is gazetting the law as it was actually passed. Whatever was earlier gazetted, if it did not reflect the duly passed law, is not a law at all.”

“Anything done outside or contrary to what the National Assembly duly passed is a nullity in law. Whatever documents are circulating that do not reflect what was actually passed by the legislature are legally worthless.”

A legal practitioner and tax consultant, Alayo Akanbi Esq., said a validly passed and gazetted law cannot be legally re-gazetted to correct material discrepancies.

“There is always a rebuttable presumption of correctness in favour of any gazetted law. It is trite law that once an Act of National Assembly is published in the official gazette, it is generally presumed correct.

“It is my view that the tax laws already passed by the National Assembly, assented to by President Bola Ahmed Tinubu which have been duly published in the Official Gazette cannot be re-gazetteed as ordered by the National Assembly on the ground that the errors identified in the gazetted tax laws are so material and fundamental that they require formal legislative process for amendment or repeal which include fresh passage of the tax laws; presidential assent and new gazette,” Akanbi said.

She argued, “Once a law has been passed and assented to by the president, it becomes valid. Its publication in the official gazette formalizes it as the public record of the law. Therefore, if the gazetted text is found to be defective, the proper constitutional remedies are either judicial nullification by a competent court or the legislative process of repeal and re-passage. An administrative order to “re-gazette” the law is not a recognised constitutional remedy.”

Badamasi Gandu Esq, said the lawmakers should have gone to court to declare the tax laws, with the alleged discrepancies, null and void “and of no legal consequences whatsoever”; while another lawyer, Ismail Abdulaziz said to remedy the situation, the legislature could either order the executive to re-gazette the version passed or amend the gazetted law and send it to the president for his assent.

“And if the Presidency remains recalcitrant on that, the National Assembly can submit the issue to the court for its determination. Interlocutory restraining orders could be sought against the Presidency in order to stop it from implementing the law pending the determination of the matter. In fact, individual citizens of Nigeria also have the locus standi to approach the court on this all important issue.”

NBA’s perspective

The president of the Nigerian Bar Association (NBA), Mazi Afam Osigwe SAN, said, ‘I don’t think it (re-gazetting) is illegal as the legality of the process depends entirely on the specific legal framework and context in which it occurs. If the re-gazetting is to correctly gazette the law that was crackly passed and assented to by the president, then it would not be unlawful. If, however, a law different from what the legislature passed was assented to by the president, then re-gazetting will not cure any insertion, deletion or modification in such laws.”

Suspend tax laws implementation-Rep minority caucus

The minority caucus of the House of Representatives has called on the federal government to immediately suspend the implementation of the tax laws until the “high powered” committee inaugurated by the House to investigate the allegations has concluded its work and there is “clarity and certainty on the laws to be implemented.”

In a statement late Sunday, jointly signed by the Minority Leader, Kingsley Chinda; Minority Whip, Ali Isa J.C.; the Deputy Minority Leader, Aliyu Madaki; and the Deputy Minority Whip, George Ozodinobi, the caucus said it was alarmed by what it described as a “storm brewing” over the tax reforms, noting that while controversies around new laws are not unusual, the present situation raises serious constitutional and legal concerns.

“We are aware of the legitimate procedures towards the gazetting of laws, and it starts with the Clerk to the National Assembly (CNA) transmitting the actual copies of the laws to the relevant federal agency that gazettes all government documents, which means, the National Assembly is always the custodian of the genuine documents of the laws of the federation that have been passed, and, therefore, we will always make sure that it is the truth that prevails in moments of controversy such as this.

“We therefore call on Nigerians to disregard any purported tax laws being circulated without the signature of the CNA and the President and Commander-in-Chief, such did not originate from the National Assembly, and neither do they reflect the true character of what were actually passed by the legislature and signed by the president.

Don’t proceed with tax laws implementation, NLC tells FG

The leadership of the Nigeria Labour Congress (NLC) yesterday again asked the federal government against proceeding with implementation of the tax laws until all the issues surrounding them are addressed.

Speaking to Daily Trust, the Acting General Secretary of NLC, Benson Upah, said, “We can’t change our position except the president has done the needful. First and foremost, there was inadequate consultation right from the beginning.

“I remember, we did write severally to that members of the committee, but that was struck off, and then there was also inadequate public enlightenment.

“For instance, we are the biggest tax-paying community in the country, there has been no public education, and I’m sure quite a number of people and communities have not been educated on what these tax laws are all about.

“Thirdly, we have the issue of gazetted outcomes. Nigerians know that the National Assembly has cried out that what they legislated and agreed upon was not what they gazetted.

“That raises big issues about the credibility, acceptability and ownership of the laws even at the level of the executive and legislature.

“So, these three issues stand for a lot. The fourth one is that, the effects of these tax laws on the ordinary Nigerians. We heard the government officials saying it will benefit ordinary Nigerians, but here we have ordinary people saying it doesn’t.

“Here we have Manufacturers’ Association of Nigeria raising their concerns. There is a need to sit down, and be on the same page about what the government wants to do for the interest of everybody.”

National Assembly mum

When contacted yesterday for clarification on the legislature’s directive for the re-gazetting of the tax laws, the Director of Information in the Office of the Clerk to the National Assembly, Bullah Audu Bi-Allah, said he could not provide answers as he was not in Abuja.

Implementation will deepen distrust – NANS

The National Association of Nigerian Students (NANS), in a statement by its president, Olushola Oladoja, warned that implementing the law in its present form was likely to deepen resentment and distrust between citizens and government authorities.

He stated, “First, the modalities for creating national orientation about this law are problematic, as Nigerians are grossly ill-informed and insufficiently enlightened about the content, scope, breadth, impacts and long-term implications of the new tax reform law.

“Across the country, there is palpable fear and widespread suspicion that this law, if implemented without proper understanding, will further burden citizens who are already struggling under severe economic hardship.

“It will weaken the viability and capacity of many businesses and individual Nigerians to cope with the economic shocks that will accompany this policy, particularly when poor public understanding of the law affects the planning and execution of financial projects in the coming year.” (Daily Trust)

-

News24 hours ago

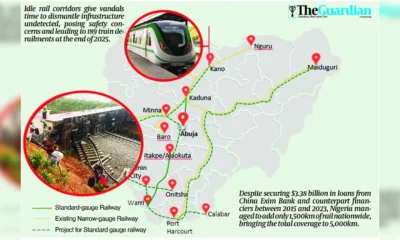

News24 hours agoFaulty design, vandalism, neglect endanger $3.4b rail overhaul

-

Business23 hours ago

Business23 hours agoDangote Cement: N760bn final dividend payout highest in history

-

World News23 hours ago

World News23 hours agoCIA working to arm Kurdish forces to spark uprising in Iran – Report

-

Business23 hours ago

Business23 hours agoMeet Ameena and Zara, the twin Indimi sisters who just won $43.51m

-

News23 hours ago

News23 hours agoMDCN indicts Euracare, Atlantis hospitals over death of Nkanu, Chimamanda’s son

-

News23 hours ago

News23 hours agoDemolition: Court threatens to send Wike to prison for contempt

-

News23 hours ago

News23 hours agoTinubu’s roll-call of billionaire friends

-

Business22 hours ago

Business22 hours agoNigeria bleeds $21m daily as output gap dents oil windfall