Business

Otedola gains N896 billion from Geregu Power majority sale

Nigerian billionaire Femi Otedola has pocketed roughly N896.5 billion from the sale of his controlling stake in Geregu Power Plc.

This marks one of the largest private exits in the country’s power sector in recent years.

The divestment, executed through the sale of his indirect holdings in Amperion Power Distribution Company Limited, represents a 5.7x return on his initial investment made at the company’s 2022 listing.

According to company filings, Otedola and his affiliated entities held 1,909,709,273 shares, representing 76.388% of the company’s issued capital as of September 30, 2025.

He reportedly sold 95% of this stake, or about 1.814 billion shares, in a $750 million transaction to MA’AM Energy Limited, which now becomes the controlling shareholder.

What the data is saying

Geregu Power listed 2.5 billion ordinary shares at N100 per share during its official listing in October 2022, implying a valuation of N250 billion at the time.

- Otedola’s stake was valued at around N190.97 billion at listing, meaning the 95% portion he ultimately sold had a notional entry value of N181.4 billion.

- At the 2022 official exchange rate of roughly N450/$1, the dollar cost of the 95% stake is estimated at $403 million.

- With an exit value of $712.5 million (after adjusting for potential fees from the $750 million headline figure), this implies a dollar gain of $309 million—a 77% return in dollar terms.

- However, using a parallel market rate of N736/$1, the estimated dollar cost drops to around $246 million, pushing dollar returns to $466 million.

This emphasizes how FX devaluation significantly amplified the naira-equivalent gains.

- In local currency terms, the sale price at an assumed N1,450/$1 exchange rate translates to a gross value of N1.0875 trillion, yielding a naira capital gain of N896.5 billion—an estimated 469% return over three years.

Share Price Surge

Geregu Power’s performance since listing has been strong and has been one of the best-performing stocks in the last three years.

The company’s market value climbed from its official listing price of N250 billion to N2.85 trillion by late 2025, driven by steady operational growth, capacity expansions, and consistent dividend payouts.

Other reports note that Otedola also benefited indirectly from dividends and retained earnings over more than a decade of operations, reinforcing the overall economic gains from his stake.

Otedola, who initially acquired Geregu under the Amperion Power subsidiary in 2013, has now converted more than a decade of strategic investment into a landmark financial windfall, cementing his position among the country’s most successful energy entrepreneurs.

Some contexts

Beyond share price appreciation, Otedola’s economic benefit from Geregu includes dividend receipts.

Geregu has been consistent in distributing profits to shareholders, highlighted by a N21.25 billion final dividend for 2024, translating to N8.50 per share, along with earlier dividends of similar magnitude.

Reports note that Geregu has averaged around N20 billion in annual dividends in recent years, further enhancing the total return to long‑term holders.

While retained earnings above N50 billion are not direct cash payouts, they reflect internal value creation that likely supported the company’s valuation for the sale, reinforcing the thesis of enduring shareholder value.

What you should know

Otedola is one of Nigeria’s widely recognised billionaires in dollar terms on the Forbes billionaire index. Infact his net worth added a major boost to the combined networth of the continent’s list of wealthy people.

According to Forbes, Africa’s wealthiest individuals gauged at a combined net worth of $82.4 billion, recording gains thanks to his return.

- An earlier report by Nairametrics showed that the former oil and gas baron and now Billionaire Banker rejoined the Forbes list a few years ago

- Before Otedola’s reentry with a net worth of $1.2 billion, ranking him as Nigeria’s fourth richest, the aggregate wealth of Africa’s billionaires was pegged at $81.5 billion in 2023, marking a $900 million increase.

- Otedola, currently valued at $1.1 billion, had been absent from the Forbes Africa list since 2017.

- His strategic divestment from oil assets in 2013, coinciding with Nigeria’s energy sector privatisation, represented a notable pivot toward power and infrastructure investments.

(Nairametrics)

-

Business18 hours ago

Business18 hours agoGas supply crisis cuts power generation to 3,940MW

-

News19 hours ago

News19 hours agoDetention: El-Rufai Petitions ICPC, Demands N15.6bn Damages

-

News18 hours ago

News18 hours agoDIG Mba, others retire, seven AIGs for promotion

-

Politics19 hours ago

Politics19 hours agoWe Will Adopt Tinubu As 2027 Presidential Candidate – APGA

-

News18 hours ago

News18 hours agoBorno: Hundreds still missing after Boko Haram attack

-

Politics18 hours ago

Politics18 hours agoTinubu Elevates Masari To Special Adviser

-

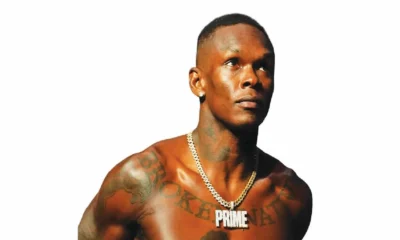

Sports18 hours ago

Sports18 hours agoAdesanya demands $15m per fight from UFC boss White

-

World News18 hours ago

World News18 hours ago‘They host US military bases used to attack us’ — Iran defends striking Gulf countries