Business

NDIC to disburse N24bn as second tranche payment to Heritage Bank depositors

The Nigeria Deposit Insurance Corporation (NDIC) has declared a N24.3 billion second liquidation dividend for depositors of the defunct Heritage Bank whose balances exceed the insured limit of N5 million.

The Central Bank of Nigeria (CBN) revoked Heritage Bank’s operational licence on June 3, 2024, raising questions about how depositors and shareholders would recover their funds.

In September 2024, NDIC said 84 percent of Heritage Bank depositors with BVN-linked accounts had been paid.

In April 2025, the corporation said it had commenced the payment of N46.6 billion from liquidation dividends to depositors of the defunct Heritage Bank.

In a statement on Sunday, Hawwau Gambo, head, communication and public affairs department, said the NDIC will commence the second tranche of the payment.

“It is in continuation thereof, that the NDIC has now declared a second liquidation dividend of ₦24.3 billion,” she said.

“This amount, derived from debt recovery, sale of physical assets, and realisation of investments, will be applied to the payment of uninsured balances for depositors with funds exceeding the ₦5 million insured limit.”

Gambo said the second liquidation dividend will be paid at a rate of 5.2 kobo per N1.00 on outstanding balances, in accordance with section 72 of the NDIC Act 2023.

She added that this raises the total liquidation dividend declared so far to 14.4 kobo per N1.00.

“Payments will be effected using depositors’ details already in the NDIC records,” Gambo said.

“Eligible depositors, who previously received the insured sum and the first tranche of liquidation dividends, will have their alternative bank accounts automatically credited using their Bank Verification Numbers (BVN).

“Depositors are advised to check their accounts for confirmation.”

She added that depositors without alternative bank accounts, bank verification numbers (BVNs), or who have not claimed their insured sum of up to N5 million or the first liquidation dividend, should visit the nearest NDIC office or complete the e-claim form.

“For clarity, a liquidation dividend is the amount paid by the NDIC to depositors of a closed bank whose balances exceed the statutory insured limit, from proceeds of asset sales, investment realization, and debt recovery,” Gambo said.

The spokesperson said the settlement of other creditors, followed by shareholders, will occur only after all depositors have been completely reimbursed, and only if sufficient funds remain.

-

Opinion10 hours ago

Opinion10 hours agoLeft behind but not forgotten

-

Politics10 hours ago

Politics10 hours agoWe Don’t Need Gov’s Support To Deliver Rivers For Tinubu – Wike

-

News9 hours ago

News9 hours agoTinubu’s ambassador-designates in limbo

-

Business9 hours ago

Business9 hours agoCBN raises alarm over Nigeria fintech’s foreign reliance

-

Politics9 hours ago

Politics9 hours agoWe’ve no plans to impeach dep gov — Kano Assembly

-

Politics9 hours ago

Politics9 hours agoElectoral Act: Amendment yet to be concluded – Akpabio tells critics

-

News9 hours ago

News9 hours agoKaduna Residents Protest Displacement Of 18 Villages By Bandits, Closure Of 13 Basic Schools

-

News9 hours ago

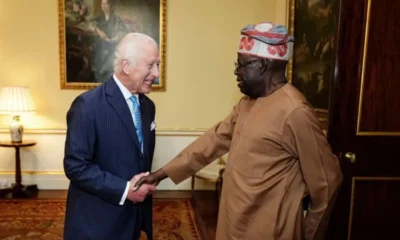

News9 hours agoTinubu Set For First UK State Visit In 37 Years