Business

VAT on bank charges NOT introduced by new tax laws – NRS

The Nigeria Revenue Service (NRS) says value-added tax (VAT) on bank services charges was not introduced by the new tax laws under the Nigeria Tax Act (NTA), 2025.

Banks had announced plans to begin deducting the 7.5 percent VAT on banking services, including point of sale (POS) transaction fees and mobile banking transfer charges, from January 19.

In a statement on Thursday, the NRS clarified that the VAT is not a new policy, saying it has always applied to fees, commissions, and charges for services rendered by banks and other financial institutions under Nigeria’s VAT regime.

“The Nigeria Revenue Service (NRS) wishes to address and correct misleading narratives circulating in sections of the media suggesting that value added tax (VAT) has been newly introduced on banking services, fees, commissions, or electronic money transfers. This claim is categorically incorrect,” the statement reads.

“VAT has always applied to fees, commissions, and charges for services rendered by banks and other financial institutions under Nigeria’s long-established VAT regime.

“The Nigeria Tax Act did not introduce VAT on banking charges, nor did it impose any new tax obligation on customers in this regard.”

The tax authority asked members of the public and stakeholders to disregard misinformation and rely solely on official communications for accurate and up-to-date tax information.(The Cable)

-

Opinion10 hours ago

Opinion10 hours agoLeft behind but not forgotten

-

Politics10 hours ago

Politics10 hours agoWe Don’t Need Gov’s Support To Deliver Rivers For Tinubu – Wike

-

News10 hours ago

News10 hours agoTinubu’s ambassador-designates in limbo

-

Business10 hours ago

Business10 hours agoCBN raises alarm over Nigeria fintech’s foreign reliance

-

Politics10 hours ago

Politics10 hours agoWe’ve no plans to impeach dep gov — Kano Assembly

-

Politics10 hours ago

Politics10 hours agoElectoral Act: Amendment yet to be concluded – Akpabio tells critics

-

News9 hours ago

News9 hours agoKaduna Residents Protest Displacement Of 18 Villages By Bandits, Closure Of 13 Basic Schools

-

News9 hours ago

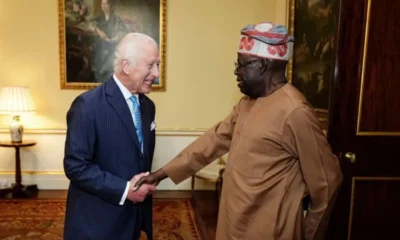

News9 hours agoTinubu Set For First UK State Visit In 37 Years