News

Idle refineries gulp N13tn as NNPC admits waste

The Nigerian National Petroleum Company Limited injected an estimated N13.2tn into the country’s three state-owned refineries in 2023 and 2024, largely to fund turnaround maintenance, operations, and associated bank charges.

This was even as the facilities continued to post heavy losses and failed to operate at commercially sustainable levels.

Recall that the Group Chief Executive Officer of NNPC, Bayo Ojulari, on Wednesday, publicly acknowledged that the refineries had become a major financial drain on the country, operating at what he described as a “monumental loss” to Nigeria.

Ojulari spoke in Abuja during a fireside chat titled ‘Securing Nigeria’s Energy Future’ at the Nigeria International Energy Summit 2026, where he offered rare insight into the commercial realities behind the long-troubled refining assets.

Figures from NNPC’s 2024 financial statements show that the Port Harcourt, Warri, and Kaduna refineries together owed the national oil company about N4.52tn in 2023. The indebtedness of the plants was put at N8.67tn by the end of 2024. The summation of both figures gives about N13.2tn.

NNPC explained in the accounts that the rising balances represented the funding of refinery operations and bank charges, especially as the past GCEO, Mele Kyari, made efforts to revamp the moribund refineries.

But his successor, Ojulari, indicated that these efforts to awaken the refineries were a mere waste of resources. “The first thing that became clear, and I want to say this very clearly, is that we were running at a monumental loss to Nigeria.

We were just wasting money. I can say that confidently now,” Ojulari said.

According to him, public anger over the refineries was justified, given the scale of funds committed to their rehabilitation over the years and the expectations that local refining would ease fuel supply challenges.

The financial statements show that the Port Harcourt refinery absorbed the largest share of funding. Its obligations to NNPC rose from about N1.99tn in 2023 to N4.22tn in 2024, an increase of more than N2.22tn in one year.

Despite the scale of spending, the refinery recorded no receivables in either year, indicating that the funds advanced for maintenance and operations were not offset by refinery revenues during the period.

At the Warri refinery, the amount owed to NNPC climbed from about N1.17tn in 2023 to N2.06tn in 2024. While Warri still recorded N81.64bn in amounts owed to it by other NNPC entities in 2023, suggesting limited internal activity, this disappeared entirely in 2024 as costs rose and operations failed to generate material income.

The Kaduna refinery, which has faced prolonged operational and security challenges, saw its obligations increase from about N1.36tn in 2023 to N2.39tn in 2024, reflecting continued spending on maintenance, staffing, security, and finance costs during the turnaround maintenance phase.

Ojulari revealed that despite the heavy spending, the refineries were being fed with crude oil on a regular basis, yet performance remained weak. “We were pumping crude into the refineries every month. But utilisation was around 50 to 55 per cent. We were spending a lot of money on operations and contractors. But when you look at the net, we were just leaking away value,” he said.

He added that what troubled the new management most was the lack of a credible path to recovery, despite the scale of investment. “Sometimes you make a loss during investment, but you have a line of sight to recovery. That line of sight was not clear here. On the refineries, Nigerians were angry. A lot of money has been spent, and expectations were very high. So we were under extreme pressure, extreme pressure,” Ojulari said.

According to him, the gravity of the losses informed one of the first major decisions of his administration: halting refinery operations to prevent further erosion of value and allow for a comprehensive reassessment of the assets.

As of the end of 2024, the three refineries still carried N8.67tn in outstanding obligations to NNPC, underscoring the financial weight of the turnaround maintenance programme and the challenge of translating years of spending into viable, self-sustaining refinery operations.

For the two years, N13.2tn went into operating the refineries and paying bank charges: N4.5tn in 2023 and N8.6tn in 2024. These funds were categorised as debt owed to the NNPC by its subsidiaries.

The figures suggest that while turnaround maintenance was ongoing in both years, the refineries remained net cost centres, relying entirely on NNPC’s balance sheet.

The PUNCH recalls that the 60,000 bpd-capacity Port Harcourt refinery resumed operations in November 2024 after years of inactivity. The NNPC’s former GCEO, Kyari, said the newly rehabilitated complex of the old Port Harcourt refinery, which had reportedly been revamped and upgraded with modern equipment, was operating at a refining capacity of 70 per cent of its installed capacity.

He added that diesel and fuel oil would be the highest outputs from the refinery, with a daily capacity of 1.5 million litres and 2.1 million litres, respectively.

This would be followed by a daily output of straight-run gasoline (naphtha) blended into 1.4 million litres of premium motor spirit (petrol), 900,000 litres of kerosene, and 2.1 million litres of low-pour fuel oil. It was stated then that about 200 trucks of petrol would be released into the Nigerian market daily from the refinery.

However, the facility was shut down again in May 2024, a month after Kyari left office.

Similarly, the Warri refinery, which was declared open in December, also went comatose again barely a month after the Kyari-claimed reopening. The former GCEO promised to reopen the Kaduna refinery and the new Port Harcourt refinery complex, but this could not be achieved until he was asked to go by President Bola Tinubu.

Last year, the President of the Dangote Group, Alhaji Aliko Dangote, said the government refineries may never work again despite $18bn spent on the facilities. Former President Olusegun Obasanjo shared similar sentiments, wondering why the NNPC kept pushing that it could revamp the plants when it knew it could not.

Consequently, the organised private sector advised the NNPC to sell off the refineries instead of retaining them as drainpipes to the country’s resources.

Reacting, Ojulari rejected the advice, boasting that the refineries would work again.

Nigerians are waiting to see what becomes of the three refineries under Ojulari’s watch.(Punch)

-

Business59 minutes ago

Business59 minutes agoOil Industry Contracting: NCDMB Issues NCEC Guidance Notes, Rules Out Transfer of Certificate

-

News24 hours ago

News24 hours agoTinubu’s ambassador-designates in limbo

-

Business24 hours ago

Business24 hours agoCBN raises alarm over Nigeria fintech’s foreign reliance

-

News57 minutes ago

News57 minutes agoElectoral Act standoff: Senate calls emergency plenary as protests loom

-

Politics24 hours ago

Politics24 hours agoElectoral Act: Amendment yet to be concluded – Akpabio tells critics

-

Politics24 hours ago

Politics24 hours agoWe’ve no plans to impeach dep gov — Kano Assembly

-

Business35 minutes ago

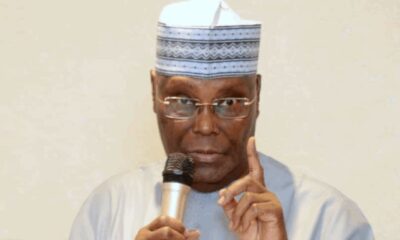

Business35 minutes ago‘Should have been sold before rehabilitation’ — Atiku asks NNPC to discontinue proposed refinery deal

-

Politics53 minutes ago

Politics53 minutes agoMakinde, Wike camps set for showdown at PDP HQ today