Business

Losses to fraud in banks decline, CBN intensifies measures

•Unveils industry-wide war on e-fraud •Internet banking fraud leads with N13.37bn, 4,507 cases •Lagos tops with 63% fraud volumes •3, 417 individuals on fraud watch list

Losses to fraud in Nigerian financial institutions declined to N25.85 billion, 51 per cent year-on-year, from N52.26 billion in 2024.

This comes as the Central Bank of Nigeria (CBN) unveils an industry-wide offensive against rising digital fraud with the aim of reducing fraud response time to less than 30 minutes.

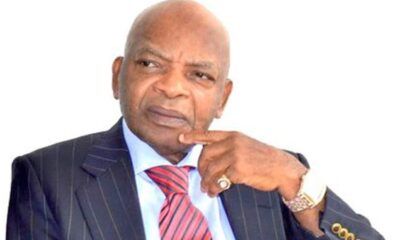

Managing Director/Chief Executive, Nigerian Interbank Settlement System, NIBSS, Mr. Premier Oiwoh, in a keynote presentation at the Nigeria Electronic Fraud Forum, NeFF, technical kick-off session held yesterday in Lagos, disclosed that the number of fraud cases declined by four per cent, to 67,518 cases in 2025 from 70,111 cases in 2024.

Oiwoh said that Internet and Mobile platforms remained the most targeted channels by volume, accounting for 27,460 and 22,470 cases respectively during the year.

According to him, Internet Banking emerged as the most financially damaging channel, recording losses of N13.37 billion from just 4,507 cases.

The data further showed that social engineering remained the most significant fraud threat in 2025, accounting for 47 per cent of total fraud volume and N17.84 billion in losses.

Other fraud techniques by volume included card theft, which accounted for 17 per cent, and robbery, with 11 per cent, reflecting the continued overlap between physical and digital crime.

Lagos leads fraud map

Geographically, Lagos State maintained its position as the country’s major fraud hotspot, accounting for over 63 per cent of total fraud volume in 2025. The Federal Capital Territory, Abuja, and other major urban centres were also identified as emerging operational bases for fraud activities.

Reporting gaps raise concern

However, despite the decline in losses, NIBSS boss raised concerns over declining fraud-reporting compliance within the industry.

According to Oiwoh, the number of institutions actively reporting fraud cases dropped from a peak of 45 in the second quarter of 2024 to 34 by the fourth quarter of 2025.

Emphasizing the need for reporting and other measures to checkmate electronic fraud, Oiwoh said: “Reporting is critical. Fraud reporting is not just about recovery; it enables tracking and prevention. We have seen cases where fraudsters left one bank and moved to another simply because there was no reporting. That must stop. There must be zero tolerance for non-reporting, whether the fraud is internal or external.

“In collaboration with the Central Bank, the Nigerian Financial Intelligence Unit (NFIU) and security agencies, NIBSS has built a Person of Interest Portal. Since 2019, about 3,417 individuals involved in fraudulent activities have been captured on the portal, complete with names and photographs. This portal is actively used by security agencies.

“All industry watchlists, the CBN database and the Person of Interest Portal have been integrated. Over 214,000 politically exposed persons (PEPs) are captured—not as criminals, but in line with regulatory requirements. APIs allow banks to validate and verify identities in real time.

“Proper validation of BVN and NIN is non-negotiable. Simply collecting these identifiers without validation is dangerous. With the systems we have built, banks can validate identities through APIs and resolve up to 95 percent of KYC challenges if fully implemented.

“Routine staff profiling, job rotation and mandatory vacation are critical to preventing internal fraud. Lifestyle monitoring should not be ignored. Many fraud cases could have been detected early if red flags had been questioned.

“Banks must cooperate, share intelligence and trust one another. Fraudsters succeed when institutions operate in silos. Collaboration is key.”

CBN unveils new industry-wide war on e-fraud

In a related development, the has unveiled an industry-wide offensive against rising digital fraud, with the aim of reducing fraud response time to less than 30 minutes.

Deputy Governor, Financial System Stability, Mr. Philip Ikeazor, disclosed this at the 2026 Nigeria Electronic Fraud Forum (NeFF) Technical Kick-Off Session in Lagos, where regulators, banks, fintechs, payment service providers, telecom operators and law enforcement agencies converged to chart a new course for fraud mitigation.

Represented by Ibrahim Umar Hassan , Director, Development and Finance Institutions Supervision, Ikeazor said the CBN, working through NeFF, is pushing for a decisive shift from reactive controls to predictive, real-time and enterprise-wide fraud management systems across the financial industry, as electronic fraud losses have risen sharply in recent years.

“Fraud is no longer merely an operational issue; it is a financial stability concern. Unchecked fraud undermines trust in digital finance, threatens financial inclusion gains and poses systemic risks to the economy,” he said.

He disclosed that the industry has agreed on concrete, measurable actions, including reducing fraud response times to under 30 minutes, a move expected to significantly improve recovery outcomes and limit systemic exposure.

According to him, NeFF has over the years played a critical role in strengthening the resilience of Nigeria’s payments system, citing landmark achievements such as the migration to EMV chip-and-PIN cards, which virtually eliminated ATM card cloning, and the introduction of mandatory two-factor authentication for electronic banking.

“These coordinated interventions helped reverse systemic vulnerabilities and led to significant reductions in e-fraud losses between 2014 and 2017, even as electronic transaction volumes expanded rapidly,” Ikeazor said.

He noted, however, that as legacy fraud schemes were contained, new and more sophisticated threats such as social engineering, SIM-swap fraud, insider compromise and authorised push payment (APP) scams have emerged, requiring stronger, faster and more coordinated responses.

As part of the new anti-fraud push, Ikeazor said the CBN is placing strong emphasis on Nigeria’s progress in identity management, particularly the Bank Verification Number (BVN) and its integration with the National Identification Number (NIN), which has significantly constrained impersonation and synthetic identity fraud.

Earlier, in her opening address, Director, Payments System Supervision Department of the CBN and Chairman of NeFF, Dr. Rakiya O. Yusuf, stressed that sustained collaboration among regulators, financial institutions, payment service providers, identity management agencies and law enforcement remains the foundation of Nigeria’s progress in combating electronic fraud.

She said the focus of the 2026 NeFF engagement is to translate improved infrastructure, shared analytics and stronger identity systems into measurable reductions in fraud losses, while safeguarding confidence in the payments system.

Looking ahead, Ikeazor said the CBN will drive the setting of bold fraud-reduction targets, strengthened accountability, deeper engagement with fintechs and telecom operators, and transparent performance measurement through industry scorecards.

-

News23 hours ago

News23 hours agoI don’t have dual citizenship because I’m an arrogant Nigerian — Fashola

-

Celebrity Gist4 hours ago

Celebrity Gist4 hours ago‘I have 14 grandchildren’, Davido‘s dad breaks silence amid son’s paternity saga

-

Metro3 hours ago

Metro3 hours agoAwujale stool: KWAM 1 hails stoppage of process

-

Politics3 hours ago

Politics3 hours ago2027: No Appointments For Non-APC Members – Nentawe

-

Business23 hours ago

Business23 hours agoSenegal revokes offshore exploration license held by Nigerian billionaire Arthur Eze

-

News4 hours ago

News4 hours ago5 soldiers killed, many injured in Boko Haram suicide attack in Borno

-

News4 hours ago

News4 hours agoICPC to arraign Ozekhome Monday over UK property

-

Business4 hours ago

Business4 hours agoIkeja Computer Village Fire: Traders appeal to Sanwo-Olu for financial support, blame power surge