Business

Oyedele clarifies Capital Gains Tax, cautions evaders

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Mr. Taiwo Oyedele, has said the introduction of a 30 per cent capital gains tax will boost the valuation of Nigerian companies and yield long-term benefits for the economy.

Oyedele made the remarks on Tuesday at the ongoing 31st Nigerian Economic Summit in Abuja.

He explained that Nigeria has tripled the capital gains tax for foreign equity investors on the sale of Nigerian shares from January, unless the proceeds are reinvested in other listed or unlisted domestic equities.

Responding to concerns about the potential impact of the new tax, Oyedele clarified that small businesses and low-income earners would be exempt.

“We have eliminated the special rate for capital gains tax. It now aligns with the income tax rate of the payer. If a small business pays zero per cent corporate tax, its capital gains tax is also zero per cent. Likewise, low-income earners exempted from PAYE will pay no capital gains tax,” he explained.

He noted that investors who sell shares worth up to N150 m annually will not pay capital gains tax, a policy that exempts more than 99 per cent of investors.

Oyedele said the reforms would improve business valuations by enhancing profitability and cash flow, which are critical to investment decisions.

“The valuation of any business is the present value of future cash flows. These reforms will significantly enhance the value of every company in Nigeria, such that the higher value will more than compensate for the additional tax,” he added.

He warned that tax evasion would become increasingly difficult under the new law due to enhanced digital monitoring and third-party validation systems.

“It is hard, if not impossible, to hide your spending even if you hide your income,” Oyedele said. “If you earn income, you must pay tax.”

He stressed that the government was committed to protecting vulnerable groups and nano businesses, such as roadside traders and artisans, through tax exemption stickers.

Oyedele added that the committee had submitted about 10 amendment proposals to the National Assembly to remove obsolete taxes, including the bicycle tax, wheelbarrow tax, and radio levy.

He also expressed optimism that recent increases in Federation Account revenues would strengthen state finances and prevent bankruptcy among subnational governments.

-

News7 hours ago

News7 hours ago‘They beat men, flogged children’ — Freed Kaduna worshippers recount ordeal in bandits’ captivity

-

News18 hours ago

News18 hours agoLagos announces six-week traffic diversion for Apongbon Bridge repairs

-

Metro19 hours ago

Metro19 hours agoMakoko’s ₦400/Month ‘Rent’ Goes Viral: A Stark Glimpse into the ‘Almajirization’ of Lagos

-

World News15 hours ago

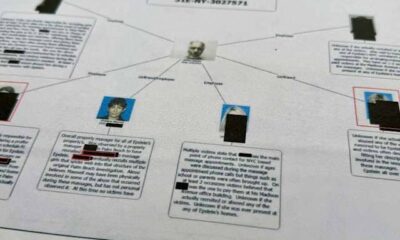

World News15 hours agoEpstein files rife with uncensored nudes and victims’ names, despite redaction efforts

-

News20 hours ago

News20 hours agoKwara massacre: Tinubu deploys army battalion to Kaiama LG

-

News10 hours ago

News10 hours agoFormer NEXIM MD Bags 490-Year Jail Term

-

News7 hours ago

News7 hours agoN219bn federal projects in 2024 budget not executed despite funds released – Tracka

-

Metro6 hours ago

Metro6 hours agoHow I ended up with a philanderer, gay man, before marrying Reuben Abati – Kikelomo Atanda-Owo