Metro

18-year-old emerges youngest Nigerian commercial pilot

Nigeria has produced one of the youngest commercial pilots at 18.

He is Mohammed Aminu Sani, who earned a United State Federal Aviation Administration (FAA) Commercial Multi-Engine Pilot License from Phoenix East Aviation (PEA) in Daytona Beach, Florida.

The 18-year-old Sani completed the entire programme in 10 months, passing every stage of training without a single checkride failure, an impressive accomplishment, even for seasoned trainees, which is a testament to discipline, resilience and focus.

Sani, in a statement, explained: “Becoming a pilot has always been my childhood dream, and today I am proud to say I’m living that dream and enjoying every step of the journey. It’s been an incredible experience filled with hard work, discipline and passion. I hope my story inspires others to chase their dreams with determination and never give up on what they believe”.

He represents a new wave of young Nigerians breaking international barriers through education, determination and excellence.

Born and raised in Abuja Nigeria, Sani completed his High School Diploma at Al-Hidaayah Academy before proceeding to The Regent College Abuja, where he graduated with Distinction in Economics Foundation.

His academic excellence laid the groundwork for his flight training in the United States. At Phoenix East Aviation, one of the world’s most respected FAA Part 141 flight schools, he trained in diverse conditions, ranging from night flights and cross-country missions to instrument-rated navigation through rain and low visibility.

He logged an impressive flight hours, including over 50 hours on multi-engine aircraft like the PA-34-200 Seneca and over 30 hours of cross-country flight time.

He now holds an FAA Commercial Pilot License (AMEL).

Beyond the numbers, Sani’s achievement resonates deeply with Nigeria’s youth population. In a time when many young people seek inspiration and global relevance, his story stands as proof that age is not a barrier to excellence and that dreams, when matched with determination, can take flight literally.

He aspires to join a leading airline, where he hopes to continue learning, flying, and representing Nigeria proudly among the world’s elite aviators.

-

Opinion4 hours ago

Opinion4 hours agoLeft behind but not forgotten

-

Politics4 hours ago

Politics4 hours agoWe Don’t Need Gov’s Support To Deliver Rivers For Tinubu – Wike

-

News4 hours ago

News4 hours agoTinubu’s ambassador-designates in limbo

-

Business4 hours ago

Business4 hours agoCBN raises alarm over Nigeria fintech’s foreign reliance

-

Politics4 hours ago

Politics4 hours agoWe’ve no plans to impeach dep gov — Kano Assembly

-

Politics4 hours ago

Politics4 hours agoElectoral Act: Amendment yet to be concluded – Akpabio tells critics

-

News4 hours ago

News4 hours agoKaduna Residents Protest Displacement Of 18 Villages By Bandits, Closure Of 13 Basic Schools

-

News4 hours ago

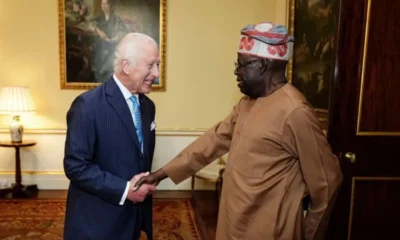

News4 hours agoTinubu Set For First UK State Visit In 37 Years