Business

Access Holdings posts N2.5tn half-year gross earnings

Access Holdings Plc has posted N2.5tn as gross earnings for the half-year period ended June 30, 2025, about 13.8 per cent higher than N2.2tn in the corresponding period of last year.

This was disclosed in the group’s half-year audited financials filed with the Nigerian Exchange Limited.

The Company Secretary, Sunday Ekwochi, in a statement accompanying the results, said that the half-year results reflected “the resilience of our business model, the diversification of our revenue streams, and the steady progress to the execution of our five-year strategic plan.”

The increase in gross earnings was driven by strong growth in interest income, which increased 38.9 per cent year-on-year to N2.0tn from N1.5bn in H1 2024.

Net interest income also increased 91.8 per cent year-on-year to N984.6bn in H1 2025 from N513.4bn in H1 2024.

Similarly, net fees and commission income rose 16.1 per cent year-on-year to N237.7bn in H1 2025 from N204.7bn in H1 2024.

Profit before tax and Profit After Tax for the period under review closed at N320.6bn and N215.9bn, respectively.

Key balance sheet indicators remain strong, with total assets, customer deposits, loans and advances, and shareholders’ equity closing at N42.4tn, N22.9tn, N13.2tn and N3.8tn, respectively.

For the banking group, interest income grew 38.7 per cent year-on-year to N2.0tn in H1 2025 from N1.5tn in H1 2024. Net interest income increased 85 per cent, from N536.7bn in H1 2024 to N992.7bn in H1 2025. Fee and commission income increased 27 per cent to N294.9bn in H1 2025 from N232.5bn in H1 2024, driven by increased transaction volumes. PBT and PAT for the banking subsidiary closed at N303.0bn and N199.3bn, respectively.

Access Holdings revealed that its banking group subsidiaries contributed 65 per cent to the PBT in H1 2025, highlighting “our journey towards sustainable performance and execution across our key African and international markets”.

The Group’s non-banking subsidiaries also maintained a strong growth momentum.

For Access – ARM Pensions, financial performance was robust, with revenue up 29.9 per cent to N21.0bn and profit before tax up 65.1 per cent to N13.1bn.

Hydrogen Payments recorded a 40.5 per cent growth in top-line revenue compared to H1 2024. PBT grew 273 per cent year-on-year. The total transaction value processed increased 211 per cent, reaching N41.1tn in H1 2025, up from N13.8tn in H1 2024.

Access Insurance Brokers has sustained strong momentum, recording a 125 per cent year-on-year increase in gross written premium, 146 per cent growth in revenue, and a 161 per cent improvement in profit before tax.

The Group’s digital lending arm, Oxygen X, has sustained strong momentum since launch in Q3 2024, delivering N5.4bn in revenue and N2.2bn in profit before tax in H1 2025.

“Access Holdings’ businesses are well-positioned to deepen market penetration, expand product offerings, and leverage cross-sell opportunities across the Group to drive continued growth and profitability.

“The group’s focus remains on driving prudent growth and continued execution of its strategic priorities, scaling its digital and transaction-led income streams, increasing revenue diversification, and embedding efficiency, innovation, and disciplined portfolio management across all areas of the business. It will also continue to uphold the highest standards of risk and governance discipline to ensure sustainable profitability,” Ekwochi concluded.

-

News12 hours ago

News12 hours agoTinubu’s ambassador-designates in limbo

-

Business12 hours ago

Business12 hours agoCBN raises alarm over Nigeria fintech’s foreign reliance

-

Politics12 hours ago

Politics12 hours agoWe’ve no plans to impeach dep gov — Kano Assembly

-

Opinion12 hours ago

Opinion12 hours agoLeft behind but not forgotten

-

Politics12 hours ago

Politics12 hours agoWe Don’t Need Gov’s Support To Deliver Rivers For Tinubu – Wike

-

Politics12 hours ago

Politics12 hours agoElectoral Act: Amendment yet to be concluded – Akpabio tells critics

-

News12 hours ago

News12 hours agoKaduna Residents Protest Displacement Of 18 Villages By Bandits, Closure Of 13 Basic Schools

-

News12 hours ago

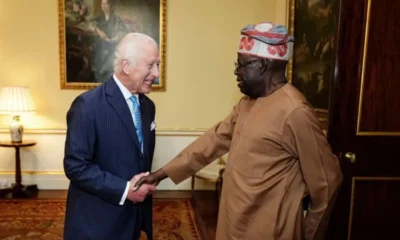

News12 hours agoTinubu Set For First UK State Visit In 37 Years