News

2024 capital projects stall 2026 budget plans

The Federal Government is yet to present the 2026 Appropriation Bill to the National Assembly, with less than two months to the end of the fiscal year, prolonging uncertainty over the country’s fiscal direction and raising fresh concerns among economists about the mounting backlog of unexecuted capital projects and the breakdown of the January–December budget cycle.

Findings by The PUNCH on Monday showed that the Budget Office of the Federation is still compiling the 2026 budget despite earlier assurances from the Bola Tinubu administration that annual budgets would return to timely submission.

The PUNCH earlier reported that the Federal Government planned to submit the 2026 national budget to the National Assembly by September 2025. This was contained in the 2026 Personnel Cost Budget Call Circular obtained from the website of the Budget Office of the Federation by The PUNCH.

Signed by the Director-General of the Budget Office of the Federation, Mr Tanimu Yakubu, the circular, dated July 7, 2025, was addressed to ministers, permanent secretaries, service chiefs, chief executives of parastatals, and other top government officials, directing them to commence preparations for the personnel component of their budget proposals for the 2026 fiscal year.

It noted that the 2026–2028 Medium-Term Expenditure Framework and Fiscal Strategy Paper must be concluded in July 2025 in line with the Fiscal Responsibility Act, 2007, to ensure the timely transmission of the budget to the legislature.

“As you are aware, the 2026–2028 Medium-Term Expenditure Framework and Fiscal Strategy Paper should be concluded by July 2025 in line with the Fiscal Responsibility Act 2007 to facilitate the submission of the 2026 budget to the National Assembly by September 2025,” the circular read.

However, as of Monday, November 17, 2025, the 2026 is yet to be approved by the Federal Executive before it can be submitted to the National Assembly. On Monday, a senior official in the Information and Communication Technology Unit of the Office of the Director-General confirmed ongoing work but declined to give details.

“We are working on it,” he said, refusing to be named because he was not authorised to speak on the matter. He explained that the rollover of the 2024 budget into 2025 “complicated the entire process” and slowed down the timeline for preparing next year’s estimates.

The official, however, would not confirm whether the 2025 budget may also spill over into 2026. The delay has revived long-standing concerns over Nigeria’s budget execution record, which has repeatedly suffered from late submissions, procurement disruptions, and inconsistent capital releases.

The PUNCH earlier in August 2025 reported that the Federal Government may extend the 2025 budget into 2026, as slow capital project implementation, procurement delays, and a shutdown of the cash-planning portal left many projects stalled about eight months into the fiscal year.

The possibility of a rollover came to light at a stakeholders’ engagement in Abuja, organised by the Office of the Accountant-General of the Federation to review progress and challenges in implementing the extended 2024 capital budget and the 2025 capital budget under the Bottom-Up Cash Planning Policy.

The PUNCH learnt that before any contract is signed, ministries, departments, and agencies must submit a monthly cash plan on an online platform provided by the OAGF. This cash plan, which sets out the projects to be funded and the amounts required, is reviewed and consolidated by the OAGF into a federal cash plan.

The consolidated plan is then sent to the Ministry of Finance for approval. Once approved, the ministry issues warrants—formal authorisations to spend—which are returned to the OAGF to be uploaded on the same portal. Only then can MDAs upload their payment plans, after which funds are released directly to contractors, suppliers, or beneficiaries.

However, since May, the portal has been locked for uploading cash plans for 2025 expenditures and contracts. Without cash plans, warrants cannot be issued; without warrants, payment plans cannot be uploaded; and without payment plans, no funds can be released.

An official familiar with developments on the matter, at a federal ministry, earlier disclosed that the implementation of the 2025 national budget is yet to commence. Speaking off the record due to the fear of being victimised, the senior official said all expenses and operations at the ministry were still being executed under the 2024 budget, which has led to widespread delays in payments to contractors and government workers.

During the 3rd Quarter Ministerial Stakeholders and Citizens Engagement Forum, hosted by the Ministry of Budget and National Planning in Abuja, the Director-General of the Budget Office of the Federation, Mr Tanimu Yakubu, said that the implementation of the 2025 national budget will commence by the end of September, as the execution of the 2024 budget draws to a close.

However, the PUNCH could not confirm if implementation had begun as of the time of filing this story. The Director of Information and Public Relations at the Ministry of Budget and Economic Planning, Mrs Julie Osagie-Jacobs, did not respond to repeated phone calls made by our correspondent on Monday.

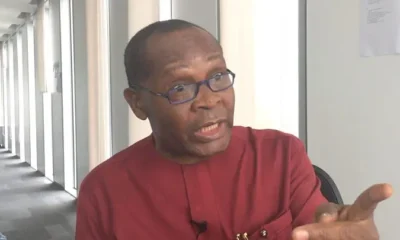

Reacting to the story, development economist and Chief Executive Officer of CSA Advisory, Dr Aliyu Ilias, said the breakdown of the budget calendar has wide implications for project planning, investor expectations, and state-level development.

He lamented that federal capital spending had become unstable again after several years of progress. He said the January–December cycle “went perfectly” for a few years and helped align government projects with private-sector planning. “Now I don’t know how they are going to manage it,” he said. “Most capital projects are also going to suffer. The normalcy we had achieved in the cycle is already broken.”

Ilias warned that delays of this scale disrupt project execution across the economy, especially in states that model their fiscal calendars around federal spending. He added that uncertainty in budget timelines reduces credibility and makes it harder for the government to coordinate reforms with expenditure priorities.

A Professor of Development Economics at the University of Lagos, Prof Femi Saibu, said the delay is a signal of deeper fiscal challenges that the Federal Government must resolve before presenting the 2026 estimates.

He identified three forces that will shape macroeconomic management next year: ongoing tax reforms, pre-election political pressures, and the large backlog of unimplemented capital budgets. He said the new tax reforms have revenue implications that must be clarified before any realistic projections can be made.

“Government needs to be sure which of these reforms will translate to revenue that can be accommodated in the budget,” he said. “Whatever goes into the 2026 budget must reflect what is actually possible to implement.”

Saibu described 2026 as “technically an election year,” stressing that political activities will intensify and shape budget priorities. He noted that governments traditionally adjust spending patterns ahead of election cycles, and the Tinubu administration will be under pressure to complete visible projects that appeal to voters.

“There are projects that must be reflected because political activities will be high,” he noted. “Government will want to accommodate as much as possible, especially in areas related to political developments.”

The academic also pointed to a much bigger problem, noting that Nigeria is currently operating with elements of two capital budgets at the same time due to repeated delays and funding constraints. “For 2025, from what we heard, the capital budget has not been implemented at all,” he said. “So we are running around two capital budgets together—2024 and 2025.”

He said the government must now decide which projects can be continued, which should be rolled over, and which should be abandoned altogether. The growing backlog, rising debt-service obligations, and limited revenue have constrained fiscal space, making it harder to embark on new capital projects without clearing the old ones.

He added that Nigeria’s borrowing space is tightening, forcing the government to scrutinise future commitments more carefully. “Given the level of borrowing, the government has to find ways to determine what it can realistically accomplish,” he said.

Despite the concerns, Saibu argued that the delay might not necessarily indicate disorganisation. He said the government may be taking more time to align the budget with economic realities and the demands of ongoing reforms.

“I think the delay is better for the government to take their time,” he said. “They want to ensure that whatever they are presenting reflects current economic realities and something they can implement.”

He warned that the government’s credibility would be undermined if higher revenues from tax reforms were not matched by visible improvements in public spending. “If the government collects more taxes from people and does less than before, it will create doubt about credibility and weaken trust,” he said.

Responding to whether the 2025 budget could also spill into 2026, Saibu said it is “very likely,” especially if current delays persist. He explained that a late passage this year would automatically push the cycle deep into next year.

“If we start the budget in September, automatically it cannot end before July or August next year,” he said. He added that the government will face intense pressure to complete critical projects before the political season begins.

The economist warned that inconsistent policy reversals in recent months have worsened the government’s fiscal pressures, strengthening the case for deeper strategic planning.

He said next year will play a decisive role in shaping public perception of the Tinubu administration as reforms continue to demand economic sacrifices from citizens. (Punch)

-

News20 hours ago

News20 hours agoFG Files Criminal Charges Against Ozekhome Over UK Property Saga

-

Business20 hours ago

Business20 hours agoPetrol war: Importers outpace domestic refineries with 62% supply in 2025

-

News20 hours ago

News20 hours agoN30bn relief: Oyo cries politics as HEDA drags Makinde to EFCC

-

Business20 hours ago

Business20 hours agoMDAs Allocate Billions For Stationeries Despite Paperless Operation

-

Politics19 hours ago

Politics19 hours ago‘Gear Up, Not Give Up’ Amidst Rivers State Turmoil – Jonathan Tells Fubara

-

Opinion15 hours ago

Opinion15 hours agoPolitics behind failed impeachment attempt of Gov. Fubara

-

Politics20 hours ago

Politics20 hours ago‘We Don’t Want A Mole’ – Igbokwe Speaks On Atiku’s Son’s Move To APC

-

Sports20 hours ago

Sports20 hours agoDrama as Senegal beat Morocco to claim AFCON title