Metro

US Woman Sues IRS, Claims Her Dog Should Count As Her Child For Tax Benefits

A New York woman has filed a lawsuit against the U.S. Internal Revenue Service (IRS), arguing that her dog should be recognised as a dependent for federal tax purposes.

In the suit, the woman claims her pet relies entirely on her for food, shelter, healthcare and daily care, similar to the way a child depends on a parent. She contends that the financial and emotional responsibility of pet ownership should qualify animals for dependent status under the tax code.

Current U.S. tax law, however, classifies pets strictly as property, not dependents. Only humans who meet specific legal criteria can be claimed, regardless of how much money or care is devoted to animals. The IRS has repeatedly rejected similar claims in the past.

Supporters of the lawsuit argue that tax policy has failed to keep pace with changing family structures. They note that many Americans now spend thousands of dollars each year on veterinary care, food, insurance, grooming and training, treating pets as full-fledged family members.

Legal experts say the case is unlikely to succeed, stressing that any change to the definition of dependents would require action by Congress, not the courts. They expect the lawsuit to be dismissed based on existing tax law and precedent.

Despite the expected outcome, the case has reignited nationwide debate among pet owners, particularly as more people delay or choose not to have children while forming strong familial bonds with their pets.

-

Opinion1 hour ago

Opinion1 hour agoLeft behind but not forgotten

-

Politics1 hour ago

Politics1 hour agoWe Don’t Need Gov’s Support To Deliver Rivers For Tinubu – Wike

-

News55 minutes ago

News55 minutes agoTinubu’s ambassador-designates in limbo

-

Business54 minutes ago

Business54 minutes agoCBN raises alarm over Nigeria fintech’s foreign reliance

-

Politics53 minutes ago

Politics53 minutes agoWe’ve no plans to impeach dep gov — Kano Assembly

-

Politics51 minutes ago

Politics51 minutes agoElectoral Act: Amendment yet to be concluded – Akpabio tells critics

-

News49 minutes ago

News49 minutes agoKaduna Residents Protest Displacement Of 18 Villages By Bandits, Closure Of 13 Basic Schools

-

News47 minutes ago

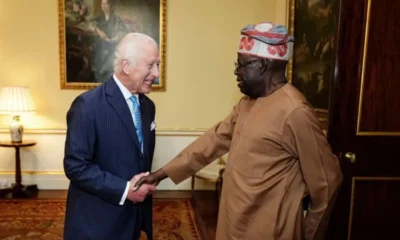

News47 minutes agoTinubu Set For First UK State Visit In 37 Years