Business

Dangote‑NNPC: A love‑hate relationship

Nigerian billionaire businessman Aliko Dangote has repeatedly accused the Nigerian National Petroleum Corporation (NNPC) of restricting his access to local crude oil while favouring imports of refined petroleum products.

After several suspensions of petrol sales in naira due to crude supply constraints, the refinery announced on 29 September the resumption of local currency sales for the domestic market.

This was made possible by the renewal – under state supervision – of the “naira for crude oil” agreement between Dangote and the NNPC, securing crude supply paid in naira for two years.

Between 2024 and 2025, Dangote reportedly purchased several million barrels of US crude to compensate for the shortfall in Nigerian oil supply.

Located in the Lekki Free Zone, on the outskirts of Lagos, Nigeria’s economic capital, the new Dangote Group facility is now preparing to operate entirely on Nigerian crude.

According to Devakumar Edwin, vice president of Dangote Group, “the refinery will be able to switch to 100% local crude” as some of the NNPC’s long-term contracts reach expiry.

In parallel, the group is finalising technical adjustments to increase its capacity from 650,000 barrels per day (bpd) to 700,000 bpd.

Fear of a monopoly

In a context where the Nigerian government’s plans to revive public refineries struggle to materialise, Dangote’s complex has become a cornerstone of the country’s energy system.

Meanwhile, the national oil company’s stake in the continent’s largest single-site refinery has dropped from 20% to 7.25%, following non-payment of the remaining $2.76bn due for the initial acquisition cost.

Dangote thus remains, in effect, the sole master on board – prompting critics to warn of a potential monopoly in the local market.

Having built his success on a dominant position in the cement sector and strong political connections – which have also drawn criticism – Dangote once called on the Nigerian government to eliminate competition from foreign refineries by banning the domestic sale of imported refined products.

This led to a lawsuit against the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), seeking to cancel fuel import licences granted to several firms, including the NNPC. The complaint was eventually withdrawn last July.

“If you label pioneers as monopolists, you will never build an industrial base,” argued the Nigerian entrepreneur.

“While fear of monopoly is widespread, it remains unfounded,” says Charles Thiémélé, the head of African operations at Turkish trading firm BGN.

“In Nigeria’s vast and complex petroleum market, none of the major international players – far more powerful and long-established than Dangote – have ever managed to establish a dominant position,” adds Thiémélé.

‘A technological and industrial revolution‘

The challenge of Dangote’s bet lies in its dual requirement: industrial success and a broader shift in the economic model.

Despite being Africa’s largest oil producer, Nigeria remains heavily dependent on fuel imports.

By seeking to end this dependency, Dangote is initiating “a technological and industrial revolution”, says Mohamed Julien Ndao, CEO of Geneva-based trader Okapi Energy.

“He is finally driving the shift towards a model of local crude transformation that generates domestic added value – a sharp break from the export-oriented raw materials economy that has prevailed until now,” says Ndao.

With refinery output nearing 550,000 barrels per day, Dangote Group has committed to supplying diesel and petrol to distributors, retailers and companies nationwide.

The group established a partnership with MRS Africa Holdings, a petroleum products marketing firm founded by Sayyu Dantata, Aliko Dangote’s half-brother, to ensure better control over the supply chain.

“In less than two years, Dangote has disrupted traditional supply networks – it’s a real game changer,” says Daniel Ndiaye, CEO of Geneva-based trading company Kemoil.

Recruited to accelerate the group’s pan-African growth strategy, David Bird, formerly of multinational Shell, has pledged “to improve efficiency and expand the company’s footprint across Africa”.

The group is currently exploring options to list its refining business on the Lagos and London stock exchanges, though no timeline has been disclosed.

While refining has historically been seen by experts as a low-margin industry, Dangote appears to have found the formula to make his investments pay off – and to secure a leading position in the local market, before setting his sights on the continent.

(The Africa Report)

-

News17 hours ago

News17 hours agoMajor, 3 Soldiers, Hunter Killed In Borno

-

News17 hours ago

News17 hours agoUmrah Suffers Setback As Airlines Suspend Flights To S/Arabia

-

Politics17 hours ago

Politics17 hours agoAtiku’s son resigns from Fintiri’s cabinet

-

News17 hours ago

News17 hours agoRevised Executive Order: FG adjusts oil revenue remittance framework

-

Politics17 hours ago

Politics17 hours agoDSS arrests social media user who ‘threatened’ Peter Obi after Edo attack

-

News17 hours ago

News17 hours agoPolice Council Confirms Disu As IG, To Be Sworn In Wednesday

-

Business17 hours ago

Business17 hours agoPrivate jet flight from Riyadh to Europe now cost N479m as elites flee Middle East tensions – Report

-

News17 hours ago

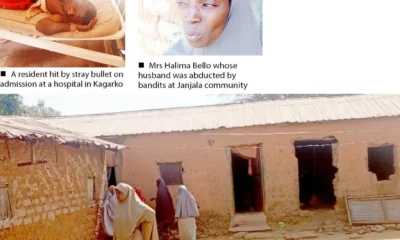

News17 hours agoVigilante, Wife, 12 Others Abducted In Kaduna