Business

Dangote’s refinery IPO could make him Africa’s first $100 billion man

In May 2025, Nigeria’s vice president Kashim Shettima made a headline-grabbing claim. He said Africa’s richest man, Aliko Dangote, could have made $120 billion by now if the $19 billion he poured into building his massive refinery had instead been invested in global technology stocks such as Amazon, Google, or Microsoft. The remark drew applause and debate in equal measure. But for Dangote, who built his fortune not through Wall Street but through cement, sugar and oil, that $120 billion target may not be out of reach after all.

The billionaire has confirmed plans to list between 5 and 10 percent of his flagship oil refinery on the Nigerian Exchange, a move that could unlock tens of billions of dollars in value. People familiar with the matter say Dangote and his advisers are eyeing a valuation of as much as $70 billion for the asset, which could catapult him into the rarefied $100 billion club. For a man who has spent decades building physical industries in one of the world’s toughest business environments, the irony is striking: Shettima’s hypothetical tech gains might soon be matched by a homegrown industrial play.

Dangote’s 650,000-barrel-a-day facility, located in the Lekki Free Zone outside Lagos, is the largest single-train refinery in the world. It’s a project of almost unimaginable scale by African standards: a complex capable of meeting Nigeria’s entire domestic fuel demand and exporting excess supply across West Africa. After years of construction delays and skepticism, the plant has begun ramping up operations, with its gasoline unit restarting in October and management targeting steady output into 2026.

In the global refining industry, the numbers tell their own story. U.S. heavyweights like Valero, Marathon Petroleum and Phillips 66 trade at market capitalizations in the $50 billion to $60 billion range, with system capacities of between two and three million barrels a day. A simple read-through on capacity would place Dangote’s plant somewhere in the teens of billions. But analysts believe the asset could command a far higher valuation because it is brand new, highly integrated, and strategically positioned in a country starved of refining capacity. Insiders say a $50 billion to $70 billion valuation is entirely plausible.

Dangote plans to keep roughly 65 to 70 percent of the company after the float, mirroring the structure of his earlier listings. If the IPO lands at the higher end of expectations, that controlling stake alone could be worth between $32 billion and $49 billion. Add his holdings in Dangote Cement, fertilizer, and other assets, and the billionaire’s fortune could surge toward $90 billion to $110 billion — a leap that would put him among the world’s richest individuals.

It would not be the first time Dangote has broken records. In 2013, he became Africa’s first $20 billion man and on Wednesday he crossed the $30 billion mark according to the Bloomberg Billionaires Index. His empire, anchored by Dangote Cement and now powered by his colossal refinery, remains one of the few on the continent capable of moving capital markets.

Critics will point to familiar risks: volatile crude supply, Nigeria’s macroeconomic headwinds, and operational hurdles in scaling such a complex facility. But those same risks are also part of the reason why a successful listing would be so significant. It would mark a rare moment when an African industrial asset commands global-scale valuation in public markets.

When Shettima made his $120 billion remark, it sounded like a missed opportunity — a measure of what could have been if Dangote had chased easy money in tech. But the billionaire built his fortune the hard way: in cement plants, sugar mills and now a refinery that dominates the Lagos skyline. If investors buy into his vision, he may soon be joining the ranks of Buffett, Ellison and Musk — not from Silicon Valley, but from Nigeria. (Billionaires Africa)

-

News15 hours ago

News15 hours agoMajor, 3 Soldiers, Hunter Killed In Borno

-

News15 hours ago

News15 hours agoUmrah Suffers Setback As Airlines Suspend Flights To S/Arabia

-

Politics16 hours ago

Politics16 hours agoAtiku’s son resigns from Fintiri’s cabinet

-

News16 hours ago

News16 hours agoRevised Executive Order: FG adjusts oil revenue remittance framework

-

News16 hours ago

News16 hours agoPolice Council Confirms Disu As IG, To Be Sworn In Wednesday

-

Politics15 hours ago

Politics15 hours agoDSS arrests social media user who ‘threatened’ Peter Obi after Edo attack

-

Business15 hours ago

Business15 hours agoPrivate jet flight from Riyadh to Europe now cost N479m as elites flee Middle East tensions – Report

-

News15 hours ago

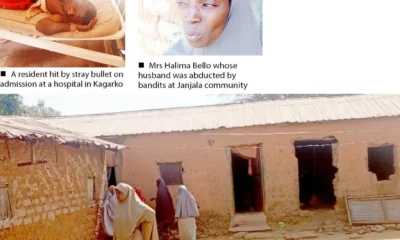

News15 hours agoVigilante, Wife, 12 Others Abducted In Kaduna