Business

GTCO RAISES N10 BILLION IN PRIVATE PLACEMENT

Guaranty Trust Holding Company Plc (“GTCO” or the “Company”) has obtained the approvals of both the Central Bank of Nigeria (“CBN”) and the Securities and Exchange Commission to undertake a private placement of its ordinary shares, subject to the fulfilment of the applicable conditions precedent and regulatory requirements.

The Financial Holding Company had earlier on August 29, 2025 announced that its banking subsidiary (Guaranty Trust Bank Limited) had satisfied and surpassed the new CBN minimum capital requirement for commercial banks with international authorisation, having already increased its capital to ₦504,037,107,058.45.

This private placement in the sum of ₦10 Billion is therefore only being raised pursuant to Section 7.1 of the Guidelines for Licensing and Regulation of Financial Holding Companies (FHCs) in Nigeria regarding the computation of the capital of FHCs.

According to a statement signed by the company’s Group General Counsel/Company Secretary, Erhi Obebeduo, the proposed private placement is being undertaken pursuant to the company’s shareholders’ resolution passed at its Annual General Meeting held on 9 May 2024 which authorised the Board to establish a capital raising programme of up to US$750,000,000.00 (Seven Hundred and Fifty Million United States Dollars) or its equivalent through the issuance of ordinary shares, preference shares, convertible and/or non-convertible bonds or any other instruments, whether by way of a public offering, private placement, rights issue, book building process or any other method or combination of methods in such tranches, and at such dates and upon terms and conditions as may be determined by the Board.

The statement further read that, “As a result of this, the Board has authorised the Company to embark on a private placement to raise N10,000,000,000.00 (Ten Billion Naira only), by the allotment of 125,000,000 (one hundred and twenty-five million) ordinary shares of ₦0.50 (Fifty Kobo) each (the “Private Placement”).

“The Company has entered into an arrangement, in connection with a best efforts private placement for gross proceeds of up to ₦10 Billion from the sale of up to 125,000,000 of the ordinary shares of the Company at ₦80 per share”.

The Offering is scheduled to close on December 31, 2025 (the “Closing Date”) and is subject to certain conditions, including, but not limited to, receipt of all necessary approvals.

Enquiries:

GTCO

Oyinade Adegite,

Group Corporate Communication

holdcocommunication@gtcoplc.com

+234-1-2715227

-

News13 hours ago

News13 hours agoGunmen Attack Kebbi Communities, Kill 35

-

Politics13 hours ago

Politics13 hours agoWike Moves ‘Rivers War Team’ to Abuja to Secure APC Victory in Council Polls

-

News13 hours ago

News13 hours ago‘Attack on PIA’ – PENGASSAN asks Tinubu to rescind executive order on oil revenue

-

Opinion13 hours ago

Opinion13 hours agoDeepfakes, the liar’s dividend and the battle for truth ahead of 2027

-

Business13 hours ago

Business13 hours agoAlleged pregnancy complications: SunTrust Bank MD seeks court permission to travel abroad

-

News14 hours ago

News14 hours agoBREAKING: Another Kano Market On Fire

-

News14 hours ago

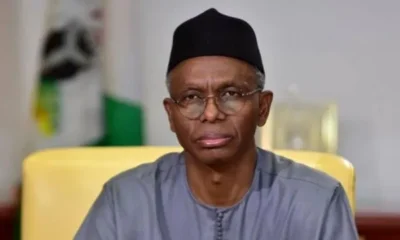

News14 hours agoEl-Rufai’s lawyer protests home raid amid ICPC detention

-

Metro11 hours ago

Metro11 hours agoHow bandits hacked Ondo monarch to death — Daughter