News

Power generation shrinks by 62% as plants operate below capacity

Nigeria’s power generation capacity remained significantly underutilised in December 2025, with grid-connected plants operating at just 38 per cent availability.

The development, which shows persistent structural weaknesses in the country’s electricity value chain after years of reform, comes at a time when the country is implementing a service-based tariff, which bills customers on a promised number of hourly supply.

According to the Operational Performance of Power Plants factsheet released by the Nigerian Electricity Regulatory Commission (NERC), only 5,151 megawatts (MW) of the country’s 13,625MW installed capacity was available for dispatch at any point during the month.

The figure translated to a plant availability factor (PAF) of 38 per cent, meaning the capacity shrank by 62 per cent.

It highlighted the widening gap between installed capacity and actual usable power.

The data show that while Nigeria nominally possesses sufficient generation capacity to meet a large share of its domestic demand, operational constraints continue to limit actual output.

Average hourly generation stood at 4,367 megawatt-hours (MWh/h), with an average load factor of 85 per cent, indicating that much of the available power was utilised and that the available capacity itself was severely constrained.

The factsheet revealed a high concentration of generation among a few power stations. The top 10 largest energy producers accounted for 81 per cent of total electricity generated in December, raising concerns about system resilience and over-reliance on a narrow pool of plants.

Hydropower stations such as Zungeru, Kainji and Jebba recorded relatively strong availability and load factors, with Zungeru operating at full availability and generating at an 83 per cent load factor.

In contrast, several thermal plants operated far below capacity, reflecting ongoing challenges linked to gas supply, maintenance backlogs, and operational inefficiencies.

Some plants recorded single-digit availability rates, while others, including Alaoji One, Ibom Power One, and Trans Amadi One, produced little or no power during the month. The outages continue to weigh heavily on national output, particularly during periods of peak demand.

Beyond generation constraints, the factsheet reveals persistent grid instability, as average grid voltage levels exceeded prescribed limits. Specifically, the lower voltage averaged 302.84kV, falling below the minimum benchmark of 313.50kV, while the upper voltage averaged 347.52kV, exceeding the maximum threshold of 346.50kV.

Frequency control also remained weak as the grid recorded an average low frequency of 49.14Hz and a high of 50.63Hz, both outside the regulatory band of 49.75Hz to 50.25Hz. The deviations signalled operational stress and increased the risk of system disturbances, including partial or total grid collapses.

Typically, unstable voltage and frequency conditions often force system operators to constrain generation to protect infrastructure, further depressing usable output even when capacity is technically available.

The December performance equally highlights the limitations of focusing reform efforts solely on installed capacity without addressing bottlenecks across gas supply, transmission, distribution, and system operations.

While Nigeria has added significant generation assets over the past decade, the inability to consistently convert capacity into delivered electricity continues to undermine power efficiency even in the face of the $2.3 billion Siemens contract implemented through the Presidential Power Initiative (PPI).

The data also raises questions about the sustainability of current market arrangements. Power producers operate in a system still plagued by payment shortfalls, which exceed N4 trillion, weak contract enforcement, and limited incentives for maintenance and efficiency improvements. For investors, low availability rates and grid instability increase operational risks and weaken confidence.

Despite relatively high utilisation of available capacity, the core challenge remains availability itself. Until gas supply reliability improves, grid stability is strengthened, and financially distressed operators are stabilised, Nigeria’s power sector is likely to remain trapped in a cycle of low output and high unmet demand.(Guardian)

-

Politics15 hours ago

Politics15 hours agoAPC Congress: Ogun, Lagos Retain Chairmen, Ondo, Oyo Elect Babatunde, Adeyemo

-

News15 hours ago

News15 hours agoDSS Arrests Police, Immigration Officials ‘Implicated’ In El-Rufai’s Return To Nigeria

-

Sports15 hours ago

Sports15 hours agoRonaldo ‘Flees’ Saudi Arabia Amid Bombardment From Iran

-

News15 hours ago

News15 hours agoRivers Assembly unveils Fubara’s commissioner nominees

-

News14 hours ago

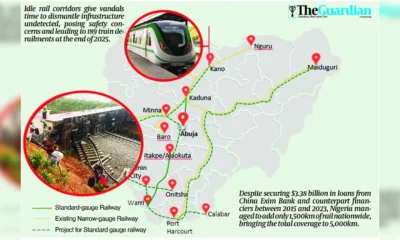

News14 hours agoFaulty design, vandalism, neglect endanger $3.4b rail overhaul

-

Business15 hours ago

Business15 hours agoBusinesses Bleed As Blackout Worsens

-

News14 hours ago

News14 hours agoFG suspends pilgrimages to Israel over Middle East security situation

-

Celebrity Gist14 hours ago

Celebrity Gist14 hours agoDiddy set for earlier prison release