Business

FX market gap widens first time in three years

Despite the demand for the dollar, the naira has remained broadly stable and continues to strengthen in the official and black markets, due to increased supply of the greenback.

According to data published by the CBN, the naira appreciated by 0.9 percent as the dollar was quoted at N1,354.26 on Monday, the strongest in two years, compared to N1,366.19 quoted on Friday at the NFEM. In the parallel, or black market, the naira traded at N1,445 per dollar, creating a gap of N91 or over 6 percent gap between official and unofficial rates.

According to a market report by Coronation Merchant Bank research department, the spread between the parallel market rate and the official exchange rate widened to N93.80 last week.

“This widening premium reflects persistent demand for foreign currency, especially in cash in the informal market, driven largely by early positioning ahead of the 2027 election cycle, rather than near-term pressures within the official FX market,” the report stated.

Olayemi Cardoso, governor of the CBN, said in November 2025 that the naira was trading within a narrow range, with the premium between official and parallel markets shrinking to below 2 percent from more than 60 percent previously.

The International Monetary Fund (IMF) said in 2023 that there were large exchange rate spreads in parallel markets in some countries like Burundi, Ethiopia, Nigeria at times, reaching 90 percent in 2022. In Nigeria, the exchange rate spread between the official and parallel market remained high at N273 per dollar in 2023.

Meanwhile, Nigeria’s gross external reserves rose significantly, increasing by $736.68 million week-on-week to $46.92 billion, from $46.18 billion. The continued build-up in reserves provides additional buffers for the Central Bank, supporting its efforts to manage FX liquidity and reinforce market confidence.

“We expect the CBN to maintain a policy focus on exchange rate stability rather than pursue aggressive currency appreciation through 2026. This approach is likely to be anchored on disciplined monetary policy, measured foreign exchange interventions, and prudent reserve management, aimed at sustaining investor confidence while containing volatility in the foreign exchange market,” analysts at Coronation said.

Mohammed Abdulahi, a black market operator, said in January 2026, there was increased demand for dollars as customers converted their naira to dollars, due to fear of losing the same to tax authorities. “But now there is low demand,” he said on Monday.

On the issue of taxes and currency conversion, a senior banker who spoke anonymously said individual circumstances largely determine exposure. “Some people don’t keep their money in naira, so the tax system doesn’t affect them directly. But if you earn in dollars, the moment you convert to naira, that transaction can be subject to tax. There’s no way to completely avoid it,” the banker said.

The banker added that businesses operating within regulatory frameworks cannot evade taxation. “If you run a legitimate business and deal with regulators, there’s no way around taxes. We’ve been paying taxes for years; the real challenge is for those who have not historically complied.” He also described the tax sweep system as unpredictable, noting that some account holders may face multiple deductions while others may not, making it difficult to anticipate total tax exposure.

Despite these concerns, the naira on Tuesday climbed to a record high of N1,372.91 per dollar in the official FX market without intervention from the CBN, underscoring the shift toward a more market-driven exchange rate regime. In recent weeks, the apex bank has largely stayed out of direct dollar sales, relying instead on improved market liquidity.

A Bureau De Change (BDC) operator told BusinessDay that some widening in the gap reflects speculative behaviour. “We’ve noticed the gap too, and we think some people are speculating ahead of the election year and hoarding dollars,” the operator said. Some BDCs also suggested that businesses were stockpiling dollars in an attempt to avoid crossing the N100 million threshold associated with company income tax obligations.

However, Muda Yusuf, Chief Executive Officer of the Centre for the Promotion of Private Enterprise (CPPE), dismissed claims that large-scale dollar conversions to avoid tax are driving FX market dynamics. He argued that if demand for dollars were rising meaningfully, the naira would be under pressure. “If more people are buying dollars, demand should increase and the naira should depreciate. But the naira is not depreciating. The exchange rate is not under pressure, so the evidence does not support that narrative,” Yusuf said.

Yusuf also clarified widespread misconceptions around corporate taxation. He explained that the N100 million threshold refers to business turnover, not the amount of cash held in bank accounts. “Turnover is about sales, not how much money is sitting in your account. Even if turnover exceeds N100 million, tax is assessed on profits, not gross revenue,” he said. He added that large transactions reported by banks, above N25 million for individuals and N100 million for corporates, do not automatically attract tax, but may trigger further review by tax authorities.

On the broader macroeconomic backdrop, Ayodele Akinwunmi, Chief Economist at United Capital Plc, said global developments are easing pressure on emerging market currencies, including the naira. He noted that the U.S. dollar has weakened against the euro amid policy uncertainty in the United States, while China is also advocating greater use of alternative currencies in trade.

Akinwunmi said oil market developments have further supported Nigeria’s external position, with prices rising above expectations partly due to geopolitical tensions involving the U.S. and Iran. He added that Nigeria’s crude oil production has increased due to renewed investment and improved investor confidence, while oil losses have declined as security and operational efficiency improve.

In addition, stronger foreign exchange inflows from the diaspora and foreign investors are helping stabilise the FX market. “These positive developments are supporting stability in the foreign exchange market, while inflation is trending downward and overall economic conditions are improving,” Akinwunmi said.

Laolu Boboye, lead economist at CardinalStone, said another key factor supporting naira appreciation in the official market is the CBN’s use of high-yield instruments, which have attracted foreign investors and boosted short-term dollar liquidity. While oil remains critical, Boboye noted a structural shift in Nigeria’s export mix toward gas and refined products.

“We’re now seeing gas exports and refined product exports account for close to 43 to 45 percent of oil-related exports. Nigeria is gradually building a new export line, which is strengthening the current account,” he said. (BusinessDay)

-

Politics23 hours ago

Politics23 hours agoAPC Congress: Ogun, Lagos Retain Chairmen, Ondo, Oyo Elect Babatunde, Adeyemo

-

News23 hours ago

News23 hours agoDSS Arrests Police, Immigration Officials ‘Implicated’ In El-Rufai’s Return To Nigeria

-

Sports23 hours ago

Sports23 hours agoRonaldo ‘Flees’ Saudi Arabia Amid Bombardment From Iran

-

News23 hours ago

News23 hours agoRivers Assembly unveils Fubara’s commissioner nominees

-

News22 hours ago

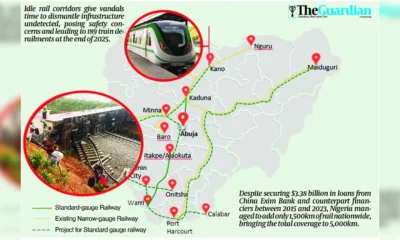

News22 hours agoFaulty design, vandalism, neglect endanger $3.4b rail overhaul

-

Celebrity Gist22 hours ago

Celebrity Gist22 hours agoDiddy set for earlier prison release

-

Business23 hours ago

Business23 hours agoBusinesses Bleed As Blackout Worsens

-

News22 hours ago

News22 hours agoFG suspends pilgrimages to Israel over Middle East security situation