Appzone secures $10m Series A, biggest investment led by Nigerian VC

It is arguably the largest Series A investment led by a local venture capital firm in Nigeria in 2021 and also has participation from other local investors including Itanna Capital Ventures, V8 Capital, and Constant Capital. US-based Lateral Investment Partners is also named among participants of the funding.

CardinalStone continues a growing trend in 2021 where local investors have taken very active participation in funding startups in Nigeria.

Foreign venture capitalists have dominated funding in the Nigerian tech ecosystem, controlling about 90 percent of investments in tech companies so far. However, in recent times, Nigerian investors have begun to increase their equity position in the ecosystem. For example, the $4.5 million in Havenbill and Bankly’s $2 million were co-led by Nigerian-founded investment firms.

According to Appzone, the funding will be deployed to its core technologies as well as kick-off expansion in more countries in Africa with the objective of building a financial operating system intended to completely digitise and automate the delivery of financial services on the continent.

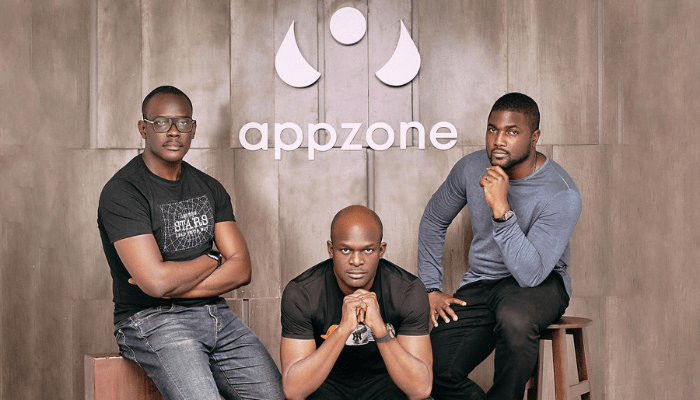

Launched in 2008 by Emeka Emetarom, Obi Emetarom, and Wale Onawunmi, Appzone works with clients in seven African countries including some of the biggest banks in Nigeria such as Access Bank, GTBank, and Zenith Bank. Appzone says it has led a number of first innovations in the digital financial world including the first decentralised payment processing network, the first core banking and omnichannel software on the cloud, and the first multi-bank direct debit service based on single global mandates.

Appzone’s platform has so far served 18 commercial banks and over 450 microfinance banks, amassing a yearly transaction value and yearly loan disbursement of $2 billion and $300 million respectively.

“Today’s news allows us to scale Appzone’s products and services rapidly. For the last 12 years, we’ve worked in stealth mode, building the really complex infrastructure to power the continent’s growing digital financial services space and forging partnerships with the continent’s biggest financial institutions,” Obi Emetarom, co-founder and CEO of Appzone said.

Appzone’s products enable traditional banks and fintech companies to grapple with the financial sector’s most pressing challenges including legacy cost structures and a major lack of operational efficiency.

Currently, due to a severe dearth of high-quality localised solutions that address these problems, traditional and challenger banks in Africa are limited to using foreign technology solutions tailored for Western markets – many of which are plagued with the huge stumbling blocks of prohibitive pricing, insufficient flexibility to innovate and a lack of local tech support.

Emetarom says the next step for Appzone is to hire “Africa’s top 1%” to grow the team it already has.