Business

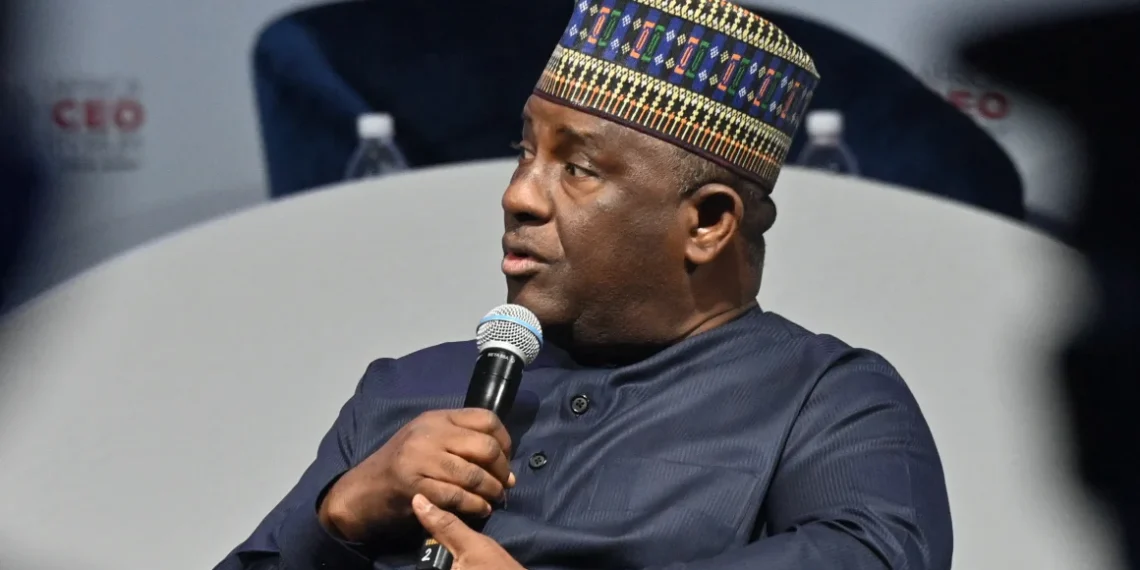

Abdulsamad Rabiu’s net worth climbs to $12.3 billion, now the 4th richest man in Africa

BUA Group Founder and Chairman, Abdul Samad Rabiu’s net worth reached a record $12.3 billion, marking a staggering $2.3 billion gain in the first six weeks of the year alone.

While Aliko Dangote remains Africa’s richest individual, the “Rabiu Rally” is being driven by a unique phenomenon on the Nigerian Exchange (NGX): the rise of BUA Foods Plc as a multi-trillion Naira heavyweight.

Rabiu, often described in business circles as “Mr. Talk and Do” for his reputation for execution, is the founder and chairman of BUA Group, a diversified conglomerate with interests spanning cement, food processing, infrastructure, and manufacturing.

Rabiu, who turned 65 this year, now sits as the 4th richest person in Africa and 273rd globally, according to the Bloomberg Billionaires Index.

In Africa, he is behind Nicky Oppenheimer of South Africa in 3rd place (216th globally) at $14 billion and Johann Rupert & family of South Africa in 2nd place (145th globally) with net worth of $18.9 billion, and Aliko Dangote remains Africa’s richest individual in 1st place at $32.7 billion (75th globally).

The Engines of Wealth: Foods vs. Cement

Rabiu’s fortune is almost entirely anchored in two listed entities where he maintains “super-majority” control, allowing him to capture nearly every Naira of value created:

He holds a 98% stake in BUA Cement, Nigeria’s second-largest producer, and 93% in BUA Foods, which saw a 91% profit leap last year amid expansions like a new Sokoto plant.

The group’s flagship cement subsidiary, BUA Cement, is Nigeria’s second-largest cement producer and generated N876 billion ($602 million) in revenue in 2024, underscoring its central role in the country’s construction and infrastructure value chain.

The ₦507 Billion “Profit Leap”

The explosive growth in Rabiu’s net worth is backed by the strongest fundamental performance in BUA’s 38-year history:

91% Profit Surge: BUA Foods reported a ₦507.7 billion after-tax profit for FY 2025, nearly doubling its 2024 results.

Rice Revolution: While sugar and flour remain the core, revenue from the Rice segment grew by an incredible 1,612% to ₦98.1 billion as the company’s massive integrated rice mill hit full capacity.

FX Mastery: Unlike competitors who struggled with currency volatility, BUA Foods slashed its FX losses by 90% (from ₦172bn to ₦16bn) through proactive hedging and a shift to local raw material sourcing.

Strategic Expansion: The 20 Million Tonne Target

Rabiu is not “cashing out” at the peak; he is doubling down on infrastructure:

Cement Capacity: Following a January meeting with SINOMA China, BUA is breaking ground on a new manufacturing line in Northern Nigeria to push group cement output toward 20 million tonnes annually.

Sugar Backward Integration: The first phase of BUA’s Lafiagi Sugar Project is set to come online in mid-2026, enabling the refining of 220,000 metric tonnesof sugar from locally grown cane.

Regional Hub: Rabiu has signaled that BUA Group is moving beyond Nigeria to become a dominant food and infrastructure supplier for the entire Sahel and West African region.

Stock Gains

Steady Rally on NGX: BUA Cement is up 13.73% YTD, while BUA Foods is up 5.77% so far in 2026. BUA Foods has a market capitalisation of N15.2 trillion ($11.25 billion), while BUA Cement’s market cap is N6.87 trillion ($5.08 billion).

-

News19 hours ago

News19 hours agoNSA cites high cost of maintaining presidential air fleet abroad, seeks supplementary funding

-

World News12 hours ago

World News12 hours agoUK: New passport rule may deny foreign-born children entry

-

News20 hours ago

News20 hours agoReal-Time Transmission: Hacking Needs To Be Avoided In This Computer Age – Tinubu

-

Celebrity Gist3 hours ago

Celebrity Gist3 hours agoI love Nicki Minaj – Donald Trump

-

Business19 hours ago

Business19 hours agoNigerian firm Eroton hit with receivership order in UK over $16.6 million debt

-

Business11 hours ago

Business11 hours agoFX for business travels soar by 366% to $672m

-

World News3 hours ago

World News3 hours agoKing Charles Breaks Silence After Arrest Of Brother, Prince Andrew, Over Misconduct Allegations

-

Politics19 hours ago

Politics19 hours ago2027: Ex-CBN Deputy Governor Tunde Lemo joins Ogun governorship race