Money market investment drives growth as mutual funds attract N1.99 trillion in H1 2025

The Nigerian mutual fund industry maintained its robust growth trajectory in the first half of 2025, attracting a net inflow of N1.99 trillion within six months.

This is according to data released by the Securities and Exchange Commission (SEC).

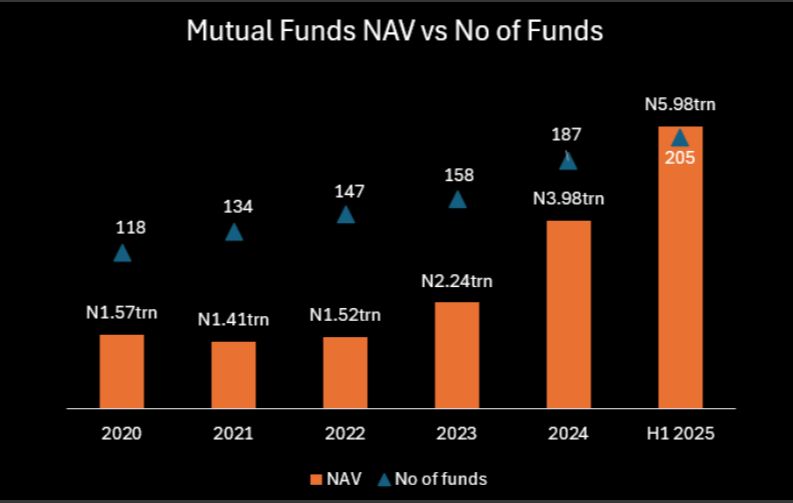

The industry’s total Net Asset Value (NAV) surged from N3.98 trillion as of December 2024 to N5.98 trillion by the end of June 2025, representing a remarkable 50% growth within the review period, having grown by 78% in 2024.

Similarly, the number of SEC-registered funds rose by 9.6%, from 187 in December 2024 to 205 as of June 2025, reflecting the addition of 18 new funds within the period. This impressive growth further reinforces the appeal of mutual funds to investors who prioritize stability, liquidity, and competitive returns amid a volatile macroeconomic environment.

The rise in Net Asset Value (NAV) was fueled by a combination of fresh capital inflows and the attractive yields generated by existing investments.

Notably, the growth was largely driven by the continued dominance of money market funds, which accounted for the bulk of new inflows. Money market funds have remained the investment vehicle of choice for risk-averse investors in Nigeria, particularly amid the high-interest rate environment sustained through 2024 and into 2025.

Money market funds attracted the largest inflows within the period under review, with their NAV expanding significantly from N1.68 trillion at the end of 2024 to a record N3.14 trillion by mid-2025.

The surge in money market fund investments reflects investor preference for short-term, low-risk instruments offering attractive yields. Elevated yields on treasury bills and commercial papers, driven by monetary policy tightening and sustained inflationary pressures, provided further incentive for capital inflows into these funds.

Beyond money market funds, other segments of the mutual fund industry also recorded healthy growth:

- Dollar Funds: Benefitting from persistent FX volatility and the demand for currency hedging, dollar-denominated funds grew modestly from N1.71 trillion to N1.92 trillion.

- REITs (Real Estate Investment Trusts): NAV in this category saw exponential growth, from N99.95 billion in 2024 to N358.38 billion by mid-2025, reflecting increased investor appetite for real assets as a hedge against inflation.

- Equity-Based Funds: While still relatively small in size, these funds expanded from N31.2 billion to N47.77 billion, benefiting from improved investor confidence in the equities market despite lingering headwinds.

- Balanced and Fixed Income Funds: These categories recorded moderate growth, with balanced funds rising from N54.71 billion to N65.74 billion, and fixed income funds edging up slightly from N196.3 billion to N209.23 billion.

Specialized funds, including thematic funds such as clean energy and gender-focused funds, though nascent, showed encouraging growth, rising from N3.7 billion at the end of 2024 to N17.63 billion by mid-2025. An indication of growing investor interest in niche markets and sustainable investing themes.

Bottom line

The surge in mutual fund NAV, particularly within money market and dollar funds, underscores the deepening trust of Nigerian investors in collective investment schemes as a viable avenue for wealth preservation and moderate growth.

The broad-based growth across fund categories signals an evolving market where investors are increasingly exploring diversified asset classes in response to both local and global economic dynamics.

(Nairametrics)