Nigeria’s economy not under recession threat – Experts

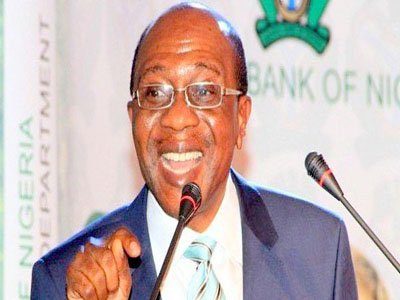

Though the Central Bank of Nigeria (CBN) Governor Godwin Emefiele Wednesday warned that the high rate of unemployment may push the country into economic crisis, the experts said the consistent growth recorded since the country exited recession insulated against any recession soon.

Mr. Johnson Chukwu, the Managing Director of Cowry Assets Management, in a chat with Daily Trust, said the country was not in danger of recession given the recent indices.

Mr. Chukwu said, “I know that the trade war between the United States and China has led to some analysts speculating that if it drags for too long, it can tick the world into a global recession. The implication would be a reduced demand for our crude oil and that is where we will get the drag.”

He said from the domestic economic activities, if the insecurity from the North East and North West affected agriculture to a near zero growth, “then we should worry. Otherwise, the growth in some sectors has the capacity to keep the country above recession.”

Speaking on the need for fiscal and monetary authorities to work together, Chukwu said, “We have seen a near absence of fiscal policies, directive and implementation.

“The major fiscal tool, the budget, has not been signed into law, and that affects the performance of the fiscal authorities. We see doldrums at the fiscal space and we hope that the new executives will reverse this trend.”

The Head of Research at Agusto & Co, Mr. Jimi Ogbobine, said the technical definition of recession was that the economy would record two consecutive quarters of contraction.

Mr. Ogbobine said, “Maybe we are not under that immediate threat, because, also, different reputable agencies have predicted between two to three per cent growth and that does not reflect a recession.

“But, with a 2.5 per cent growth, what we will experience is an erosion of consumer purchasing power because the population growth rate is outstripping GDP growth. That is the real threat.”

Bismark Rewane, an economist and the Managing Director of Financial Derivatives, said the Nigerian economy would not fall back into recession.

Rewane gave the assurance at the USA Fair 2019 on Tuesday in Lagos while speaking on “Forecast and Recommendations for the Nigerian Economy in Buhari’s Second Term”.

According to him, Nigeria’s GDP at $482bn, growth rate at two per cent, and the population at 190 million are indicators of an economy on a path of growth.

He noted that the real estate sector, which had suffered a consecutive decline in previous quarters, grew in the GDP report of Q1, 19; indicating that the economy would continue to expand.

The economist suggested a power sector reform which should include the conversion of the N1tn power sector debts into equity and a cost-reflective tariff as a way of deepening economic growth.

Other analysts’ suggestions are investing in new pipelines; ending financial waivers and exemptions; listing NNPC on the stock market; reducing petrol subsidy in 2019 and scrapping it in 2020, and a change in the Foreign Exchange (FOREX) market structure.

Rewane said that using monetary policy to solve fiscal problems would be ineffective, adding that between 2019 and 2023, there would be strong fiscal presence backed by complementary monetary measures to drive growth.

Optimistic of continuous economic growth, the economist said the major catalyst would be a review of petroleum pricing mechanism and FOREX rate.

However, the Director General of the Lagos Chamber of Commerce and Industry (LCCI), Muda Yusuf, said the nation may be plunged into another recession if the economy continues to run on unviable fiscal regime, unsustainable indebtedness, as well as huge cost of governance.