Stock market defies lockdown as equities recover

•Investors net N150b gains

• Turnover rises by 60%

THE stock market has seen increased level of activities and considerable recovery as the market continues to operate unhindered in spite of the full lockdown of Lagos State, Nigeria’s main economic centre.

All benchmark indices for the Nigerian stock market closed positive at the weekend with the turnover rising by about 60 per cent on the back of bargain-hunting that left investors with net capital gains of N150 billion. Average gain for the week closed weekend at 1.37 per cent, the first gain in the past five weeks.

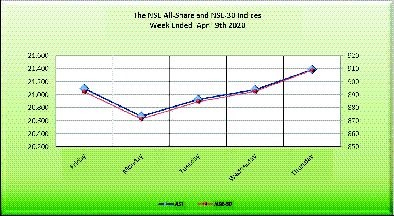

Aggregate market value of quoted equities on the Nigerian Stock Exchange (NSE) regained the N11 trillion mark at N11.144 trillion at the weekend, compared with N10.994 trillion recorded as opening value for the week. The All Share Index (ASI)- the common value-based index that tracks all share prices at the NSE, also trended upward from its week’s opening index of 21,094.62 points to close weekend at 21,384.03 points.

Total turnover increased to 2.44 billion shares worth N19.93 billion in 18,918 deals last week, representing increase of 59.5 per cent and 76.9 per cent on turnover volume and value recorded in the previous week. Investors had traded a total of 1.53 billion shares valued at N11.27 billion in 18,928 deals two weeks ago.

The primary issue segment of the market has also remained active with many companies raising capital in recent period. The NSE last week listed three bonds valued at N36.5 billion. Flour Mills of Nigeria Plc listed its N12.5 billion three-years 10 per cent series three, tranche A, fixed rate senior unsecured bond due 2023 and N7.5 billion five-year 11.10 per cent series three, tranche B, fixed rate senior unsecured bond due 2025. Also, Primero BRT listed its N16.5 billion series one, 17 per cent fixed rate bonds due 2026 under the N100 billion medium term bond programme.

Lagos State, Nigeria’s main economic centre and traditionally the city centre of stock market transactions is the epicentre of the Coronavirus pandemic. President Muhammadu Buhari had ordered a total lockdown of Lagos State, alongside the Federal Capital Territory (FCT), and Ogun State. The NSE subsequently closed its trading floors nationwide and transited to fully digital remote operations on Wednesday March 25, 2020.

According to him, since the activation of its business continuity plan in response to COVID-19 on Wednesday, March 25, 2020, the Exchange has transitioned to digital operations with its employees working remotely and dealing member firms trading remotely.

He pointed out that the Exchange has had no disruptions to its operations since the activation of the slow down efforts by state and federal governments to flatten the Covid-19 curve.

“We have put in place the requisite measures to guarantee that our staff are able to provide requisite support, our stakeholders are able to conduct business digitally, and that all relevant information continues to flow into the market to spur capital market activity during the Covid-19 pandemic,” Onyema said.

Further analysis of transactions at the stock market showed a broad recovery in share prices across the sectors. With nearly two advancers for every decliner, most sectoral indices closed on the upside. The NSE Banking Index posted a double-digit gain of 12.39 per cent. The NSE Consumer Goods Index appreciated by 6.50 per cent while the NSE Insurance Index inched up by 0.18 per cent. However, the NSE Oil and Gas Index declined by 4.76 per cent while the NSE Industrial Goods Index dropped by 6.59 per cent.

The financial services sector dominated the activity chart with a turnover of 2.18 billion shares valued at N11.11 billion in 11,322 deals; representing 89.4 per cent and 55.7 per cent of the total equity turnover volume and value respectively. The industrial goods sector occupied a distant second position with a turnover of 102.77 million shares worth N3.63 billion in 2,483 deals while the consumer goods sector placed third with a turnover of 51.08 million shares worth N3.58 billion in 1,924 deals.

Three banking stocks, Omoluabi Mortgage Bank Plc, Guaranty Trust Bank Plc and FBN Holdings Plc, were the three most active stocks, accounting for 1.70 billion shares worth N8.03 billion in 4,443 deals, representing 69.8 per cent and 40.3 per cent of the total equity turnover volume and value respectively.

There were 35 gainers against 18 losers last week compared with 15 gainers and 36 losers recorded in the previous week. Lafarge Africa recorded the highest gain, in percentage terms, of 41.3 per cent to close at N12.65. Wema Bank followed with a gain of 25.5 per cent to close at 59 kobo. United Bank for Africa rose by 25.3 per cent to close at N6.20. Sterling Bank appreciated by 25.2 per cent to close at N1.39 while Fidelity Bank rose by 24.3 per cent to close at N2.10.

On the negative side, Ardova, former Forte Oil, recorded the highest loss of 18.5 per cent to close at N11.25. Sky Aviation Handling Company followed with a drop of 15.6 per cent to close at N2. BUA Cement dropped by 12.8 per cent to close at N30.80. Learn Africa and Cutix lost 10 per cent each to close at 90 kobo and N1.26 respectively while BOC Gases dropped by 9.9 per cent to close at N3.65 per share.